Authors

Summary

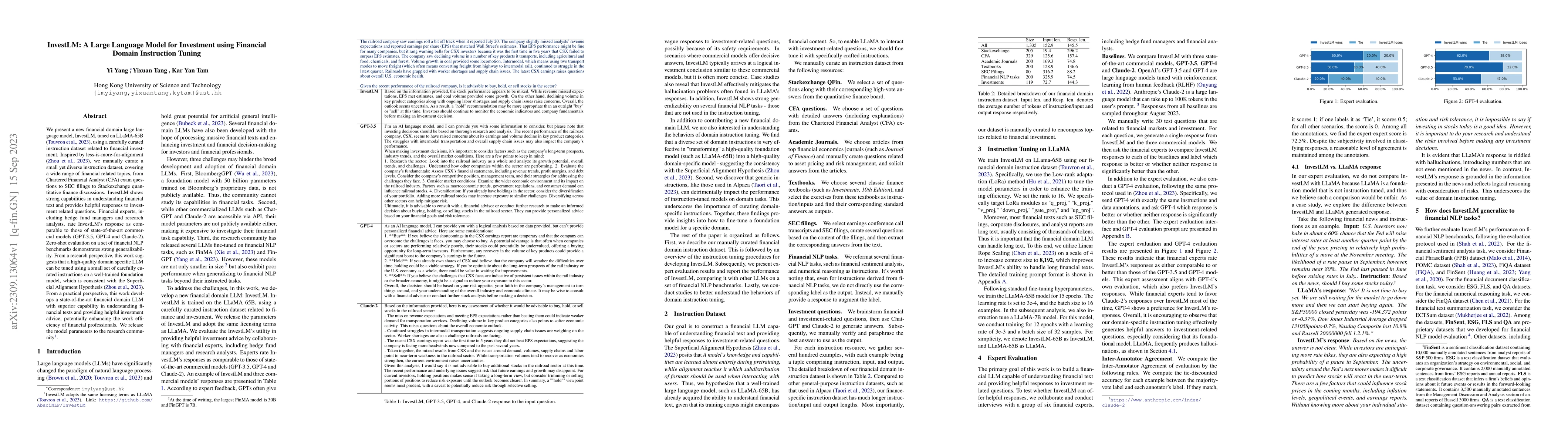

We present a new financial domain large language model, InvestLM, tuned on LLaMA-65B (Touvron et al., 2023), using a carefully curated instruction dataset related to financial investment. Inspired by less-is-more-for-alignment (Zhou et al., 2023), we manually curate a small yet diverse instruction dataset, covering a wide range of financial related topics, from Chartered Financial Analyst (CFA) exam questions to SEC filings to Stackexchange quantitative finance discussions. InvestLM shows strong capabilities in understanding financial text and provides helpful responses to investment related questions. Financial experts, including hedge fund managers and research analysts, rate InvestLM's response as comparable to those of state-of-the-art commercial models (GPT-3.5, GPT-4 and Claude-2). Zero-shot evaluation on a set of financial NLP benchmarks demonstrates strong generalizability. From a research perspective, this work suggests that a high-quality domain specific LLM can be tuned using a small set of carefully curated instructions on a well-trained foundation model, which is consistent with the Superficial Alignment Hypothesis (Zhou et al., 2023). From a practical perspective, this work develops a state-of-the-art financial domain LLM with superior capability in understanding financial texts and providing helpful investment advice, potentially enhancing the work efficiency of financial professionals. We release the model parameters to the research community.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinGPT: Instruction Tuning Benchmark for Open-Source Large Language Models in Financial Datasets

Neng Wang, Hongyang Yang, Christina Dan Wang

JMedLoRA:Medical Domain Adaptation on Japanese Large Language Models using Instruction-tuning

Hiroki Sakaji, Masahiro Suzuki, Issey Sukeda et al.

A Comparative Analysis of Instruction Fine-Tuning LLMs for Financial Text Classification

Yuheng Hu, Sorouralsadat Fatemi, Maryam Mousavi

DISC-FinLLM: A Chinese Financial Large Language Model based on Multiple Experts Fine-tuning

Wei Chen, Xuanjing Huang, Xiang Bai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)