Summary

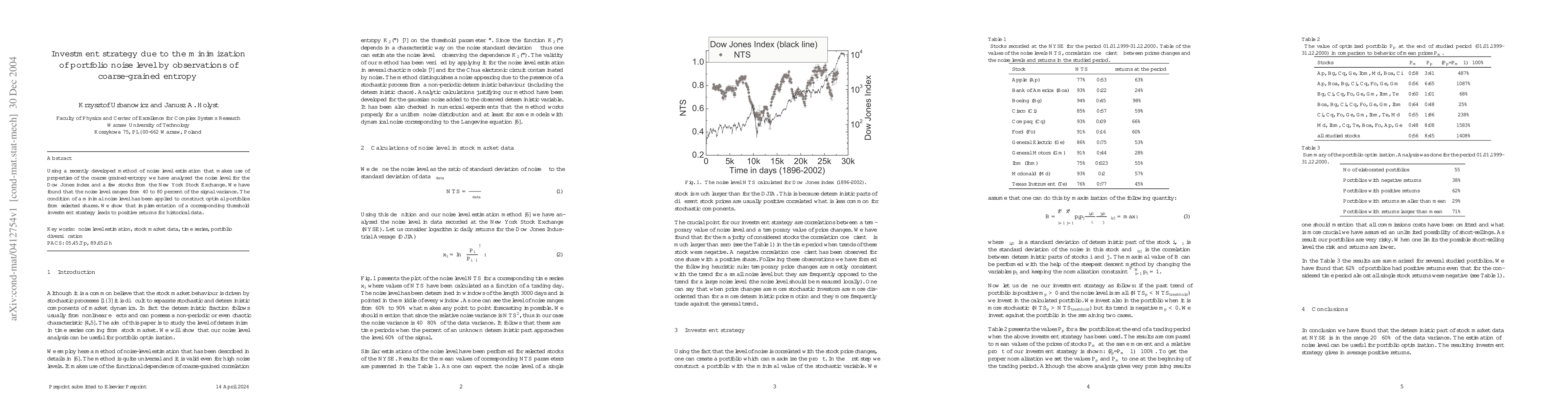

Using a recently developed method of noise level estimation that makes use of properties of the coarse grained-entropy we have analyzed the noise level for the Dow Jones index and a few stocks from the New York Stock Exchange. We have found that the noise level ranges from 40 to 80 percent of the signal variance. The condition of a minimal noise level has been applied to construct optimal portfolios from selected shares. We show that implementation of a corresponding threshold investment strategy leads to positive returns for historical data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)