Summary

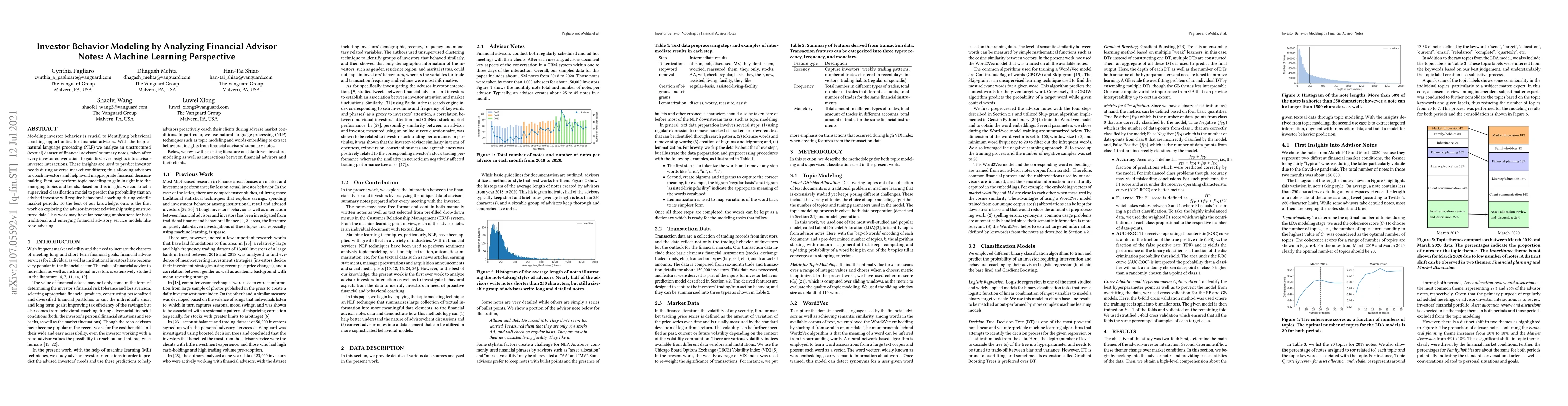

Modeling investor behavior is crucial to identifying behavioral coaching opportunities for financial advisors. With the help of natural language processing (NLP) we analyze an unstructured (textual) dataset of financial advisors' summary notes, taken after every investor conversation, to gain first ever insights into advisor-investor interactions. These insights are used to predict investor needs during adverse market conditions; thus allowing advisors to coach investors and help avoid inappropriate financial decision-making. First, we perform topic modeling to gain insight into the emerging topics and trends. Based on this insight, we construct a supervised classification model to predict the probability that an advised investor will require behavioral coaching during volatile market periods. To the best of our knowledge, ours is the first work on exploring the advisor-investor relationship using unstructured data. This work may have far-reaching implications for both traditional and emerging financial advisory service models like robo-advising.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDelayed Detection, Swift Blame: Investor Responses to Advisor Misconduct in Market Downturns

Jun Honda

A survey of air combat behavior modeling using machine learning

Patrick Ribu Gorton, Andreas Strand, Karsten Brathen

Investor behavior and multiscale cross-correlations: Unveiling regime shifts in global financial markets

George Kapetanios, Marina Dolfin, Leone Leonida et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)