Summary

One of the most important empirical findings in microeconometrics is the pervasiveness of heterogeneity in economic behaviour (cf. Heckman 2001). This paper shows that cumulative distribution functions and quantiles of the nonparametric unobserved heterogeneity have an infinite efficiency bound in many structural economic models of interest. The paper presents a relatively simple check of this fact. The usefulness of the theory is demonstrated with several relevant examples in economics, including, among others, the proportion of individuals with severe long term unemployment duration, the average marginal effect and the proportion of individuals with a positive marginal effect in a correlated random coefficient model with heterogenous first-stage effects, and the distribution and quantiles of random coefficients in linear, binary and the Mixed Logit models. Monte Carlo simulations illustrate the finite sample implications of our findings for the distribution and quantiles of the random coefficients in the Mixed Logit model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

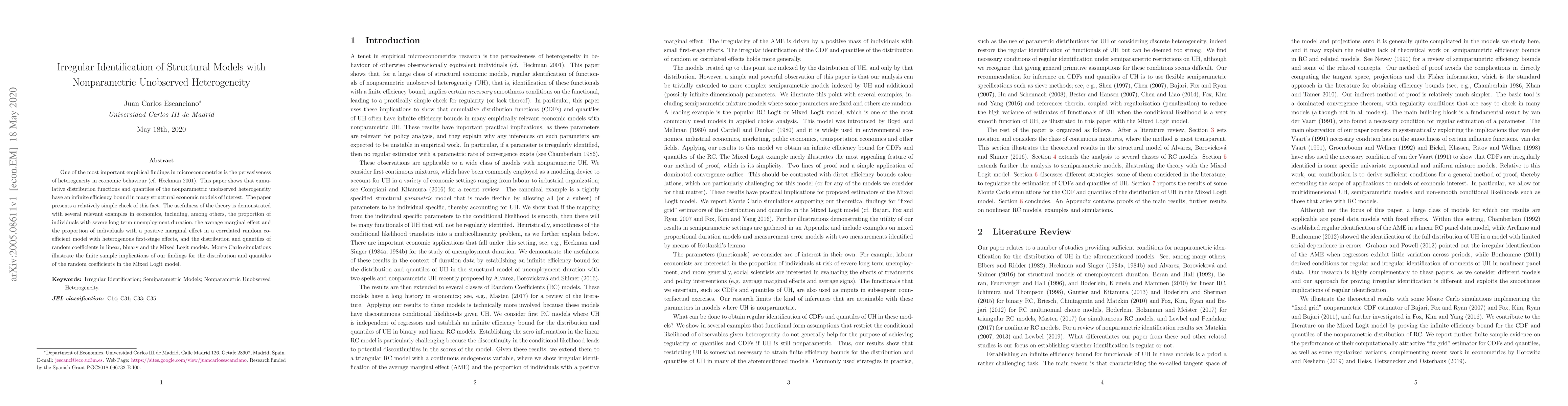

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentification and Estimation of Production Function with Unobserved Heterogeneity

Hiroyuki Kasahara, Paul Schrimpf, Michio Suzuki

| Title | Authors | Year | Actions |

|---|

Comments (0)