Summary

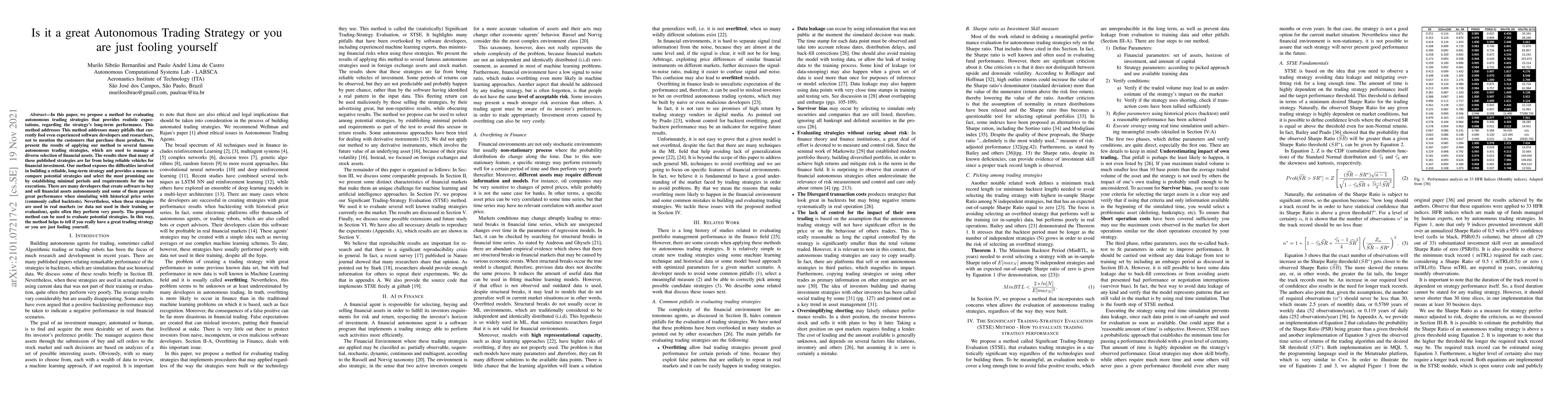

In this paper, we propose a method for evaluating autonomous trading strategies that provides realistic expectations, regarding the strategy's long-term performance. This method addresses This method addresses many pitfalls that currently fool even experienced software developers and researchers, not to mention the customers that purchase these products. We present the results of applying our method to several famous autonomous trading strategies, which are used to manage a diverse selection of financial assets. The results show that many of these published strategies are far from being reliable vehicles for financial investment. Our method exposes the difficulties involved in building a reliable, long-term strategy and provides a means to compare potential strategies and select the most promising one by establishing minimal periods and requirements for the test executions. There are many developers that create software to buy and sell financial assets autonomously and some of them present great performance when simulating with historical price series (commonly called backtests). Nevertheless, when these strategies are used in real markets (or data not used in their training or evaluation), quite often they perform very poorly. The proposed method can be used to evaluate potential strategies. In this way, the method helps to tell if you really have a great trading strategy or you are just fooling yourself.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIt Is Not Where You Are, It Is Where You Are Registered: IoT Location Impact

Anat Bremler-Barr, David Hay, Bar Meyuhas et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)