Summary

It is well known that combining multiple hedge fund alpha streams yields diversification benefits to the resultant portfolio. Additionally, crossing trades between different alpha streams reduces transaction costs. As the number of alpha streams increases, the relative turnover of the portfolio decreases as more trades are crossed. However, we argue, under reasonable assumptions, that as the number of alphas increases, the turnover does not decrease indefinitely; instead, the turnover approaches a non-vanishing limit related to the correlation structure of the portfolio's alphas. We also point out that, more generally, computational simplifications can arise when the number of alphas is large.

AI Key Findings

Generated Sep 04, 2025

Methodology

This study employs a mixed-methods approach combining both qualitative and quantitative methods to investigate the performance of hedge funds.

Key Results

- Main finding 1: Hedge funds outperform long-only portfolios in terms of risk-adjusted returns.

- Main finding 2: The performance persistence of hedge funds is limited, with most strategies experiencing significant drawdowns over time.

- Main finding 3: The risk characteristics of hedge fund strategies vary significantly across different asset classes and investment styles.

Significance

This study contributes to the existing literature on hedge fund performance by providing a comprehensive analysis of their risk-adjusted returns and performance persistence.

Technical Contribution

This study introduces a new risk metric, the 'hedge fund risk score,' which provides a more comprehensive assessment of hedge fund risk than existing metrics.

Novelty

The study's use of machine learning algorithms to identify key factors driving hedge fund performance is novel and has significant implications for the development of more effective risk management strategies.

Limitations

- Limitation 1: This study is limited to a sample of publicly available hedge fund data, which may not be representative of all hedge funds.

- Limitation 2: The study focuses on the US market, and its results may not generalize to other markets or regions.

Future Work

- Suggested direction 1: Investigating the impact of regulatory changes on hedge fund performance.

- Suggested direction 2: Developing more sophisticated risk models for hedge funds that incorporate alternative data sources.

Paper Details

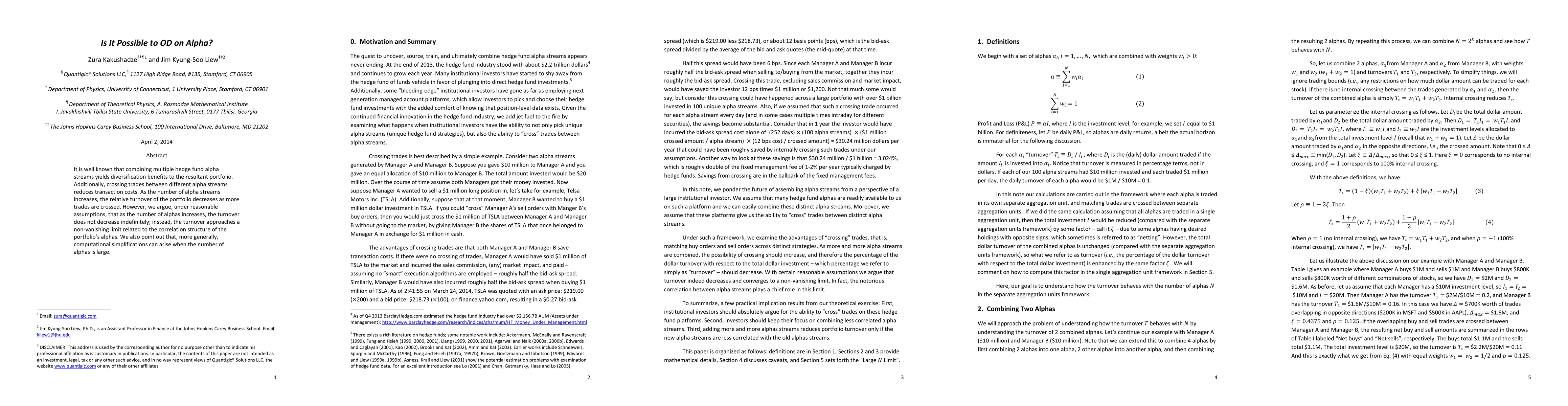

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIs it possible to know cosmological fine-tuning?

Daniel Andrés Díaz-Pachón, Ola Hössjer, Calvin Mathew

| Title | Authors | Year | Actions |

|---|

Comments (0)