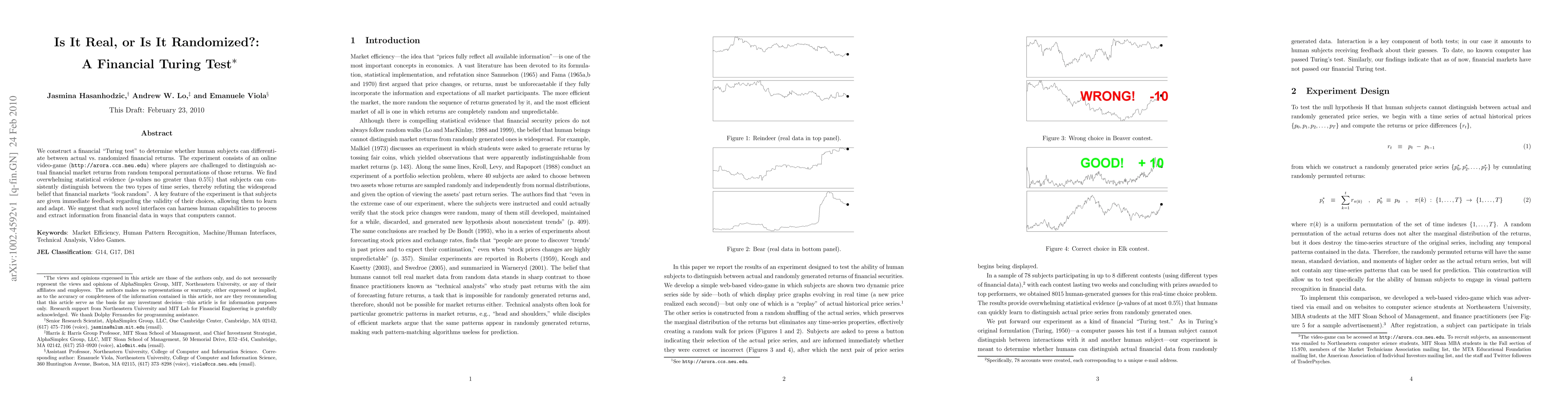

Summary

We construct a financial "Turing test" to determine whether human subjects can differentiate between actual vs. randomized financial returns. The experiment consists of an online video-game (http://arora.ccs.neu.edu) where players are challenged to distinguish actual financial market returns from random temporal permutations of those returns. We find overwhelming statistical evidence (p-values no greater than 0.5%) that subjects can consistently distinguish between the two types of time series, thereby refuting the widespread belief that financial markets "look random." A key feature of the experiment is that subjects are given immediate feedback regarding the validity of their choices, allowing them to learn and adapt. We suggest that such novel interfaces can harness human capabilities to process and extract information from financial data in ways that computers cannot.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTell me Habibi, is it Real or Fake?

Muhammad Haris Khan, Injy Hamed, Abhinav Dhall et al.

Is disruption decreasing, or is it accelerating?

R. Alexander Bentley, Benjamin D. Horne, Blai Vidiella et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)