Summary

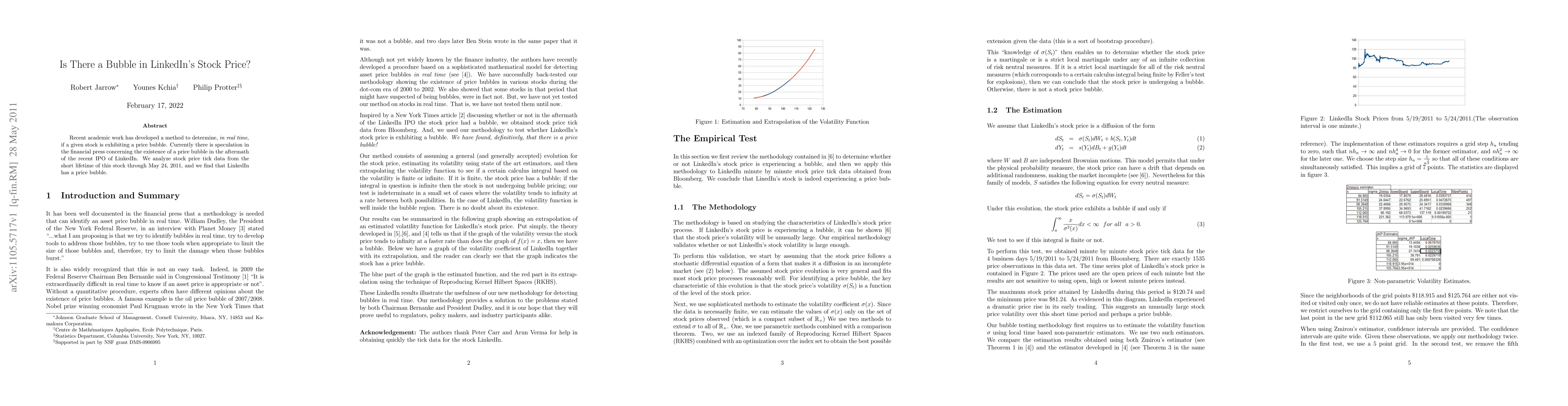

Recent academic work has developed a method to determine, in real time, if a given stock is exhibiting a price bubble. Currently there is speculation in the financial press concerning the existence of a price bubble in the aftermath of the recent IPO of LinkedIn. We analyze stock price tick data from the short lifetime of this stock through May 24, 2011, and we find that LinkedIn has a price bubble.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)