Summary

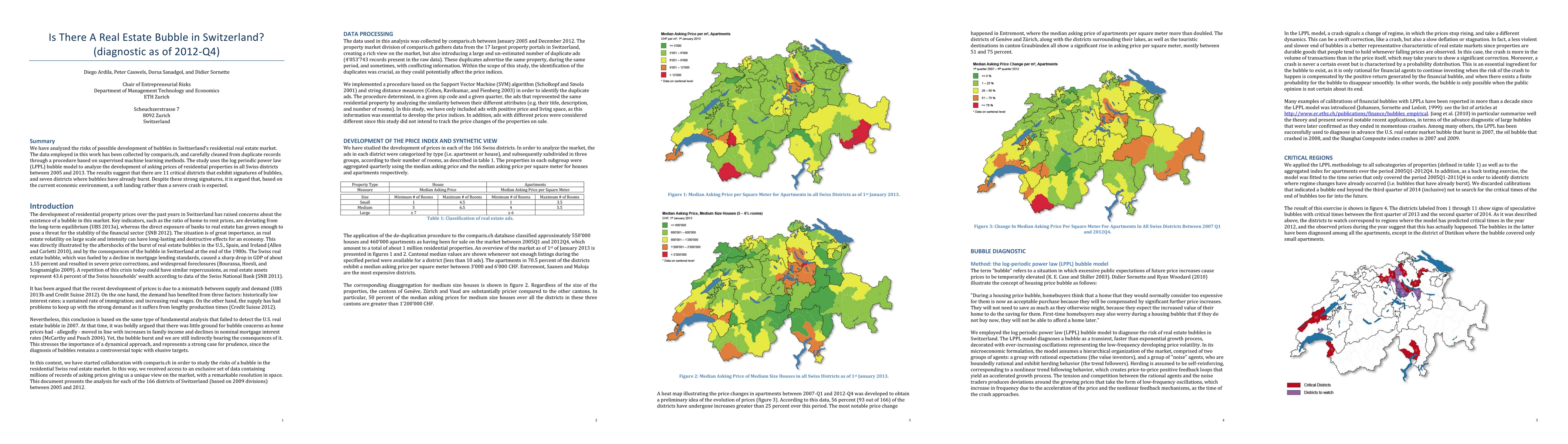

We have analyzed the risks of possible development of bubbles in the Swiss residential real estate market. The data employed in this work has been collected by comparis.ch, and carefully cleaned from duplicate records through a procedure based on supervised machine learning methods. The study uses the log periodic power law (LPPL) bubble model to analyze the development of asking prices of residential properties in all Swiss districts between 2005 and 2013. The results suggest that there are 11 critical districts that exhibit signatures of bubbles, and seven districts where bubbles have already burst. Despite these strong signatures, it is argued that, based on the current economic environment, a soft landing rather than a severe crash is expected.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers2000-2003 Real Estate Bubble in the UK but not in the USA

D. Sornette, W. -X. Zhou

| Title | Authors | Year | Actions |

|---|

Comments (0)