Summary

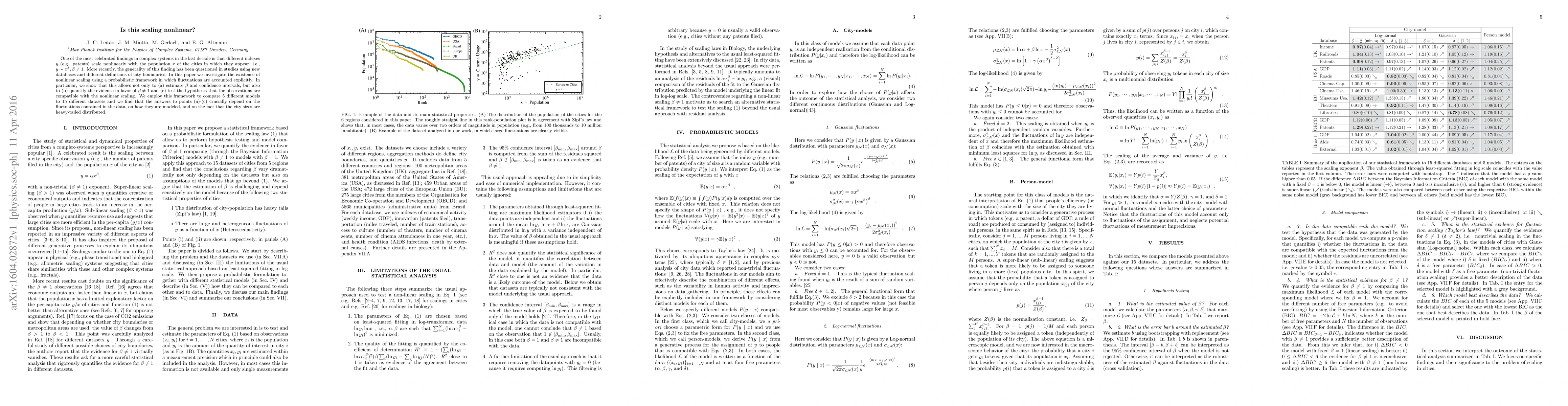

One of the most celebrated findings in complex systems in the last decade is that different indexes y (e.g., patents) scale nonlinearly with the population~x of the cities in which they appear, i.e., $y\sim x^\beta, \beta \neq 1$. More recently, the generality of this finding has been questioned in studies using new databases and different definitions of city boundaries. In this paper we investigate the existence of nonlinear scaling using a probabilistic framework in which fluctuations are accounted explicitly. In particular, we show that this allows not only to (a) estimate $\beta$ and confidence intervals, but also to (b) quantify the evidence in favor of $\beta \neq 1$ and (c) test the hypothesis that the observations are compatible with the nonlinear scaling. We employ this framework to compare $5$ different models to $15$ different datasets and we find that the answers to points (a)-(c) crucially depend on the fluctuations contained in the data, on how they are modeled, and on the fact that the city sizes are heavy-tailed distributed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPerspective Functions with Nonlinear Scaling

Patrick L. Combettes, Francisco J. Silva, Luis M. Briceño-Arias

| Title | Authors | Year | Actions |

|---|

Comments (0)