Summary

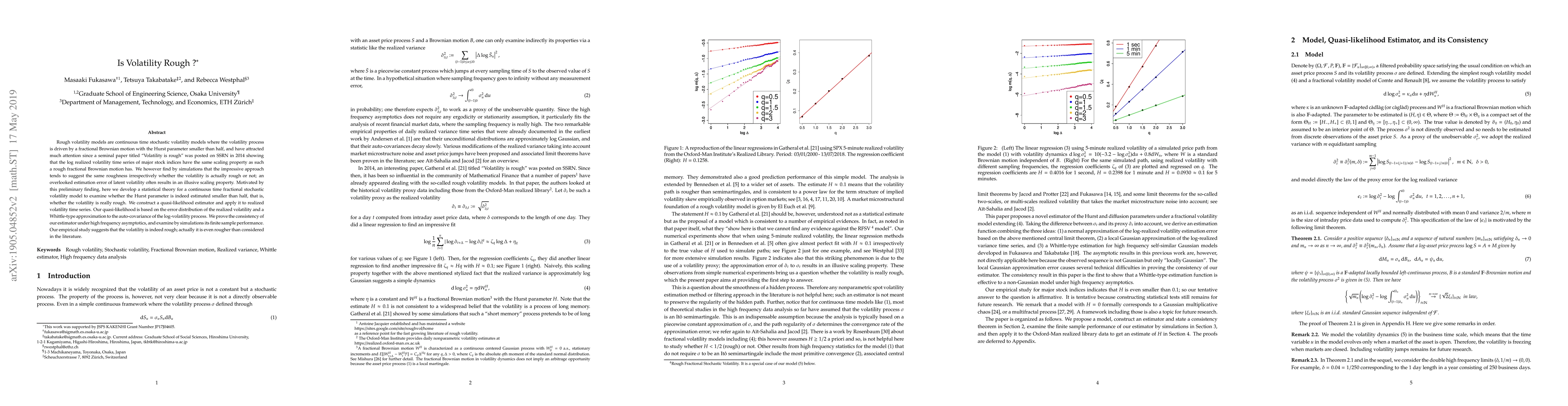

Rough volatility models are continuous time stochastic volatility models where the volatility process is driven by a fractional Brownian motion with the Hurst parameter smaller than half, and have attracted much attention since a seminal paper titled "Volatility is rough" was posted on SSRN in 2014 showing that the log realized volatility time series of major stock indices have the same scaling property as such a rough fractional Brownian motion has. We however find by simulations that the impressive approach tends to suggest the same roughness irrespectively whether the volatility is actually rough or not; an overlooked estimation error of latent volatility often results in an illusive scaling property. Motivated by this preliminary finding, here we develop a statistical theory for a continuous time fractional stochastic volatility model to examine whether the Hurst parameter is indeed estimated smaller than half, that is, whether the volatility is really rough. We construct a quasi-likelihood estimator and apply it to realized volatility time series. Our quasi-likelihood is based on the error distribution of the realized volatility and a Whittle-type approximation to the auto-covariance of the log-volatility process. We prove the consistency of our estimator under high frequency asymptotics, and examine by simulations its finite sample performance. Our empirical study suggests that the volatility is indeed rough; actually it is even rougher than considered in the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLocal volatility under rough volatility

Peter K. Friz, Paolo Pigato, Stefano De Marco et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)