Authors

Summary

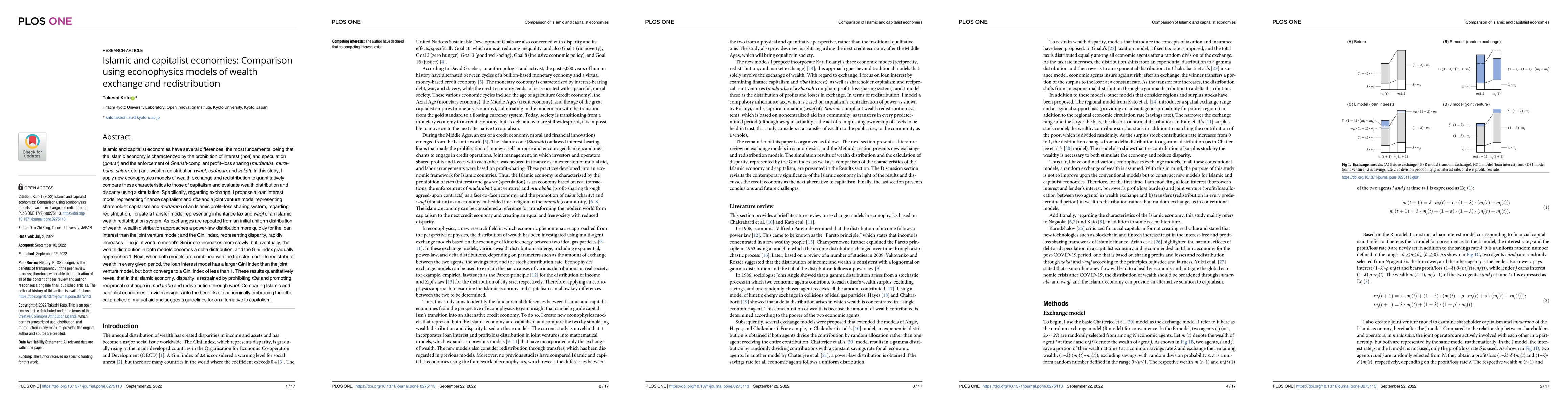

Islamic and capitalist economies have several differences, the most fundamental being that the Islamic economy is characterized by the prohibition of interest (riba) and speculation (gharar) and the enforcement of Shariah-compliant profit-loss sharing (mudaraba, murabaha, salam, etc.) and wealth redistribution (waqf, sadaqah, and zakat). In this study, I apply new econophysics models of wealth exchange and redistribution to quantitatively compare these characteristics to those of capitalism and evaluate wealth distribution and disparity using a simulation. Specifically, regarding exchange, I propose a loan interest model representing finance capitalism and riba and a joint venture model representing shareholder capitalism and mudaraba; regarding redistribution, I create a transfer model representing inheritance tax and waqf. As exchanges are repeated from an initial uniform distribution of wealth, wealth distribution approaches a power-law distribution more quickly for the loan interest than the joint venture model; and the Gini index, representing disparity, rapidly increases. The joint venture model's Gini index increases more slowly, but eventually, the wealth distribution in both models becomes a delta distribution, and the Gini index gradually approaches 1. Next, when both models are combined with the transfer model to redistribute wealth in every given period, the loan interest model has a larger Gini index than the joint venture model, but both converge to a Gini index of less than 1. These results quantitatively reveal that in the Islamic economy, disparity is restrained by prohibiting riba and promoting reciprocal exchange in mudaraba and redistribution through waqf. Comparing Islamic and capitalist economies provides insights into the benefits of economically embracing the ethical practice of mutual aid and suggests guidelines for an alternative to capitalism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWealth Redistribution and Mutual Aid: Comparison using Equivalent/Nonequivalent Exchange Models of Econophysics

Takeshi Kato

Wealth inequality and utility: Effect evaluation of redistribution and consumption morals using macro-econophysical coupled approach

Takeshi Kato, Mohammad Rezoanul Hoque

Market, power, gift, and concession economies: Comparison using four-mode primitive network models

Takeshi Kato, Ryuji Mine, Junichi Miyakoshi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)