Summary

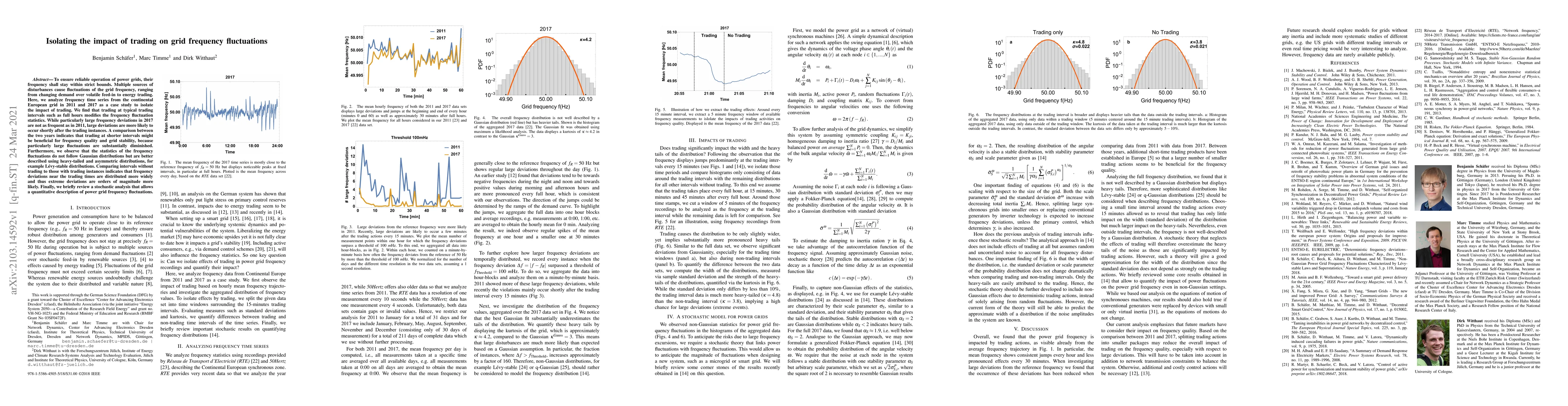

To ensure reliable operation of power grids, their frequency shall stay within strict bounds. Multiple sources of disturbances cause fluctuations of the grid frequency, ranging from changing demand over volatile feed-in to energy trading. Here, we analyze frequency time series from the continental European grid in 2011 and 2017 as a case study to isolate the impact of trading. We find that trading at typical trading intervals such as full hours modifies the frequency fluctuation statistics. While particularly large frequency deviations in 2017 are not as frequent as in 2011, large deviations are more likely to occur shortly after the trading instances. A comparison between the two years indicates that trading at shorter intervals might be beneficial for frequency quality and grid stability, because particularly large fluctuations are substantially diminished. Furthermore, we observe that the statistics of the frequency fluctuations do not follow Gaussian distributions but are better described using heavy-tailed and asymmetric distributions, for example L\'evy-stable distributions. Comparing intervals without trading to those with trading instances indicates that frequency deviations near the trading times are distributed more widely and thus extreme deviations are orders of magnitude more likely. Finally, we briefly review a stochastic analysis that allows a quantitative description of power grid frequency fluctuations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)