Summary

Green bonds have been shown to be effective tool for sustainability however market growth is impeded by high issuance and transaction costs. The lack of appropriate standardisation and frameworks raise fear of greenwashing. In this paper, we propose a platform for green bond issuance on the Algorand blockchain. It offers "Green Bonds as a Service", increasing accessibility through automation. The solution has minimal associated costs and supports fractional asset ownership, both of which will help adoption especially in developing countries. A financial regulator must preapprove an investor and can freeze assets in the case of financial irregularities. Green bonds can be bought directly from an issuer or in the secondary market. We also introduce a novel mechanism whereby an issuer can upload proof of impact reports. A green verifier uses these to submit a green rating; poor green ratings result in reputational damage and economic penalties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

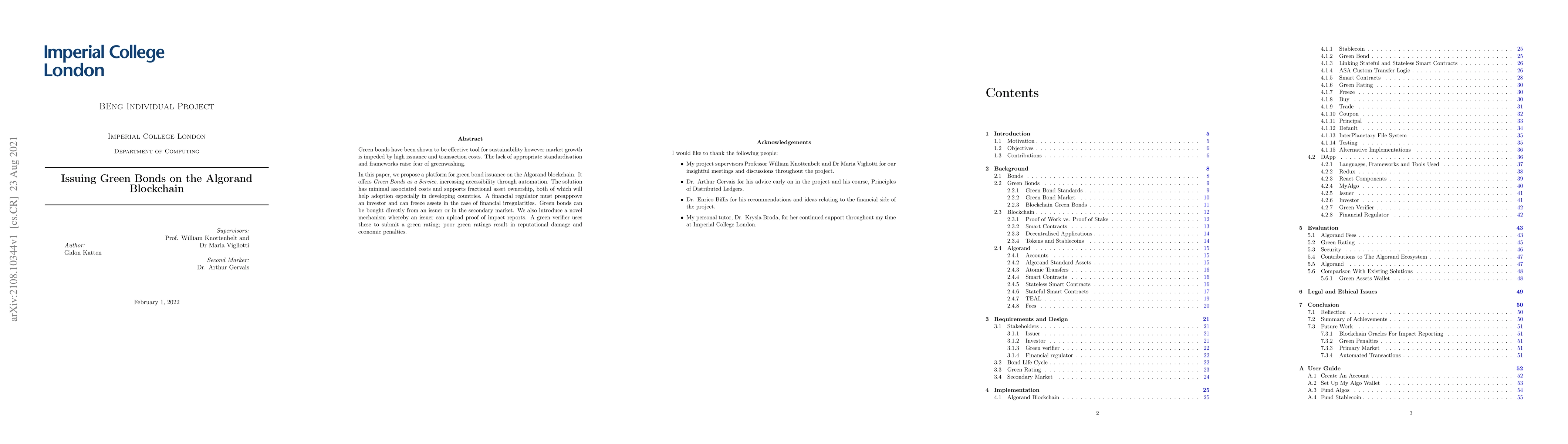

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDistributed and Adversarial Resistant Workflow Execution on the Algorand Blockchain

Haiqin Wu, Boris Düdder, Yibin Xu et al.

Reputation-based PoS for the Restriction of Illicit Activities on Blockchain: Algorand Usecase

Sandeep Kumar Shukla, Mayank Pandey, Rachit Agarwal et al.

Quantifying the Blockchain Trilemma: A Comparative Analysis of Algorand, Ethereum 2.0, and Beyond

Chuang Hu, Ye Wang, Luyao Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)