Summary

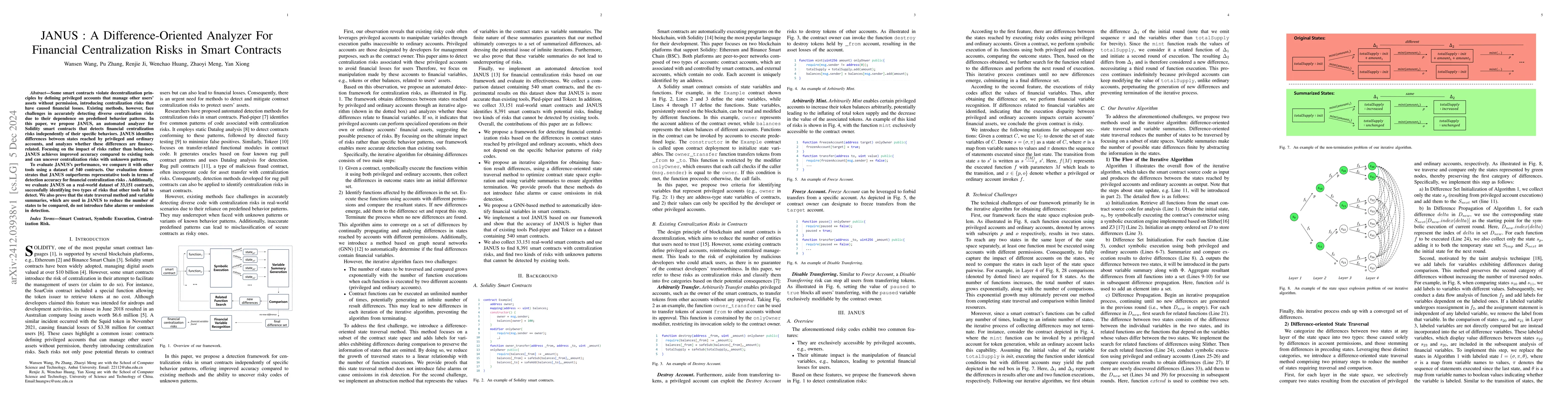

Some smart contracts violate decentralization principles by defining privileged accounts that manage other users' assets without permission, introducing centralization risks that have caused financial losses. Existing methods, however, face challenges in accurately detecting diverse centralization risks due to their dependence on predefined behavior patterns. In this paper, we propose JANUS, an automated analyzer for Solidity smart contracts that detects financial centralization risks independently of their specific behaviors. JANUS identifies differences between states reached by privileged and ordinary accounts, and analyzes whether these differences are finance-related. Focusing on the impact of risks rather than behaviors, JANUS achieves improved accuracy compared to existing tools and can uncover centralization risks with unknown patterns. To evaluate JANUS's performance, we compare it with other tools using a dataset of 540 contracts. Our evaluation demonstrates that JANUS outperforms representative tools in terms of detection accuracy for financial centralization risks . Additionally, we evaluate JANUS on a real-world dataset of 33,151 contracts, successfully identifying two types of risks that other tools fail to detect. We also prove that the state traversal method and variable summaries, which are used in JANUS to reduce the number of states to be compared, do not introduce false alarms or omissions in detection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAn Automated Analyzer for Financial Security of Ethereum Smart Contracts

Zhaoyi Meng, Wansen Wang, Wenchao Huang et al.

Definition and Detection of Centralization Defects in Smart Contracts

Zibin Zheng, Jiachi Chen, Jiajing Wu et al.

End-user Comprehension of Transfer Risks in Smart Contracts

Ezekiel Soremekun, Sudipta Chattopadhyay, Sumei Sun et al.

WACANA: A Concolic Analyzer for Detecting On-chain Data Vulnerabilities in WASM Smart Contracts

Zhaoyi Meng, Wansen Wang, Wenchao Huang et al.

No citations found for this paper.

Comments (0)