Summary

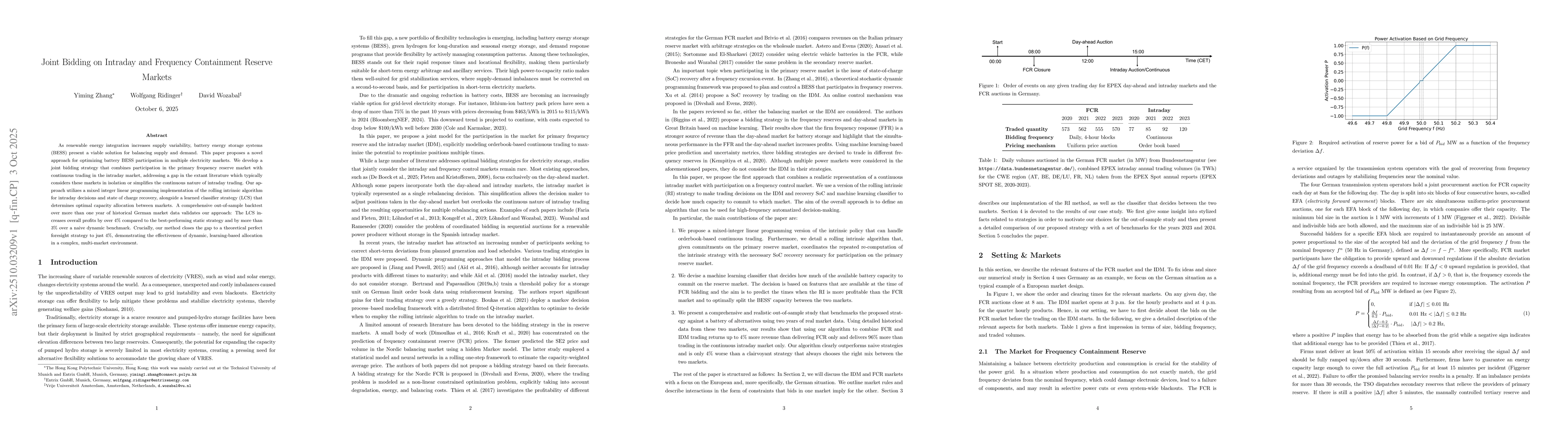

As renewable energy integration increases supply variability, battery energy storage systems (BESS) present a viable solution for balancing supply and demand. This paper proposes a novel approach for optimizing battery BESS participation in multiple electricity markets. We develop a joint bidding strategy that combines participation in the primary frequency reserve market with continuous trading in the intraday market, addressing a gap in the extant literature which typically considers these markets in isolation or simplifies the continuous nature of intraday trading. Our approach utilizes a mixed integer linear programming implementation of the rolling intrinsic algorithm for intraday decisions and state of charge recovery, alongside a learned classifier strategy (LCS) that determines optimal capacity allocation between markets. A comprehensive out-of-sample backtest over more than one year of historical German market data validates our approach: The LCS increases overall profits by over 4% compared to the best-performing static strategy and by more than 3% over a naive dynamic benchmark. Crucially, our method closes the gap to a theoretical perfect foresight strategy to just 4%, demonstrating the effectiveness of dynamic, learning-based allocation in a complex, multi-market environment.

AI Key Findings

Generated Oct 12, 2025

Methodology

The research employs a hierarchical approach combining a high-frequency rolling intrinsic algorithm for intraday trading and state-of-charge management with an XGBoost classifier to select optimal FCR commitments from a pre-screened pool of complementary strategies. The methodology includes backtesting on historical market data and uses anchored walk-forward validation for hyperparameter tuning.

Key Results

- The proposed LCS strategy achieves 96.4% of the theoretical maximum profit (CV-28), outperforming static and naive dynamic benchmarks by 4.0% and 7.1% respectively.

- Dynamic strategies (CV-28, CV-3, LCS) consistently achieve higher profits compared to other strategies, with LCS showing stable performance during low-profit periods.

- The FCR market dominates profitability, with the 'Only FCR' strategy being the best choice on 37.1% of days, indicating strong FCR commitment value.

Significance

This research provides a practical framework for optimizing battery energy storage system participation in frequency containment reserve and intraday markets, offering significant improvements over existing methods and demonstrating the value of machine learning in energy market strategies.

Technical Contribution

The technical contribution lies in the integration of a high-frequency rolling intrinsic algorithm with an XGBoost classifier for dynamic strategy selection, enabling effective management of complex energy market participation.

Novelty

The novelty of this work is the hierarchical optimization framework combining real-time trading algorithms with machine learning-based strategy selection, offering a more adaptive and profitable approach to energy storage system participation in multiple markets.

Limitations

- The framework relies on a curated set of FCR strategies, which may limit its adaptability to changing market conditions.

- The model assumes zero-price bids in FCR auctions and uses a suboptimal myopic RI for intraday trading.

Future Work

- Enhance intraday trading algorithms using reinforcement learning to increase profitability and diversify viable strategies.

- Endogenize FCR bid prices by estimating opportunity costs through forecasting models to optimize both quantity and price of FCR commitments.

Paper Details

PDF Preview

Similar Papers

Found 5 papersCoordinated Trading Strategies for Battery Storage in Reserve and Spot Markets

Paul E. Seifert, Emil Kraft, Steffen Bakker et al.

Temporal-Aware Deep Reinforcement Learning for Energy Storage Bidding in Energy and Contingency Reserve Markets

Hao Wang, Yanru Zhang, Jinhao Li et al.

Proximal Policy Optimization Based Reinforcement Learning for Joint Bidding in Energy and Frequency Regulation Markets

Hao Wang, Changlong Wang, Muhammad Anwar et al.

Strategic Bidding in the Frequency-Containment Ancillary Services Market

Carlos Matamala, Goran Strbac

Comments (0)