Summary

We analyze the joint extremal behavior of $n$ random products of the form $\prod_{j=1}^m X_j^{a_{ij}}, 1 \leq i \leq n,$ for non-negative, independent regularly varying random variables $X_1, \ldots, X_m$ and general coefficients $a_{ij} \in \mathbb{R}$. Products of this form appear for example if one observes a linear time series with gamma type innovations at $n$ points in time. We combine arguments of linear optimization and a generalized concept of regular variation on cones to show that the asymptotic behavior of joint exceedance probabilities of these products is determined by the solution of a linear program related to the matrix $\mathbf{A}=(a_{ij})$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

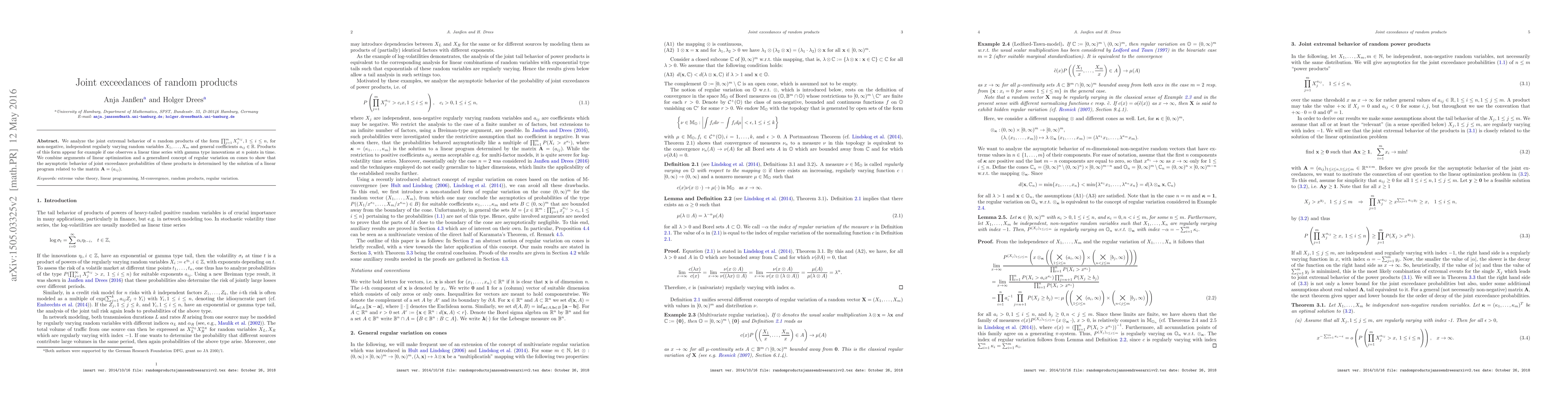

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)