Summary

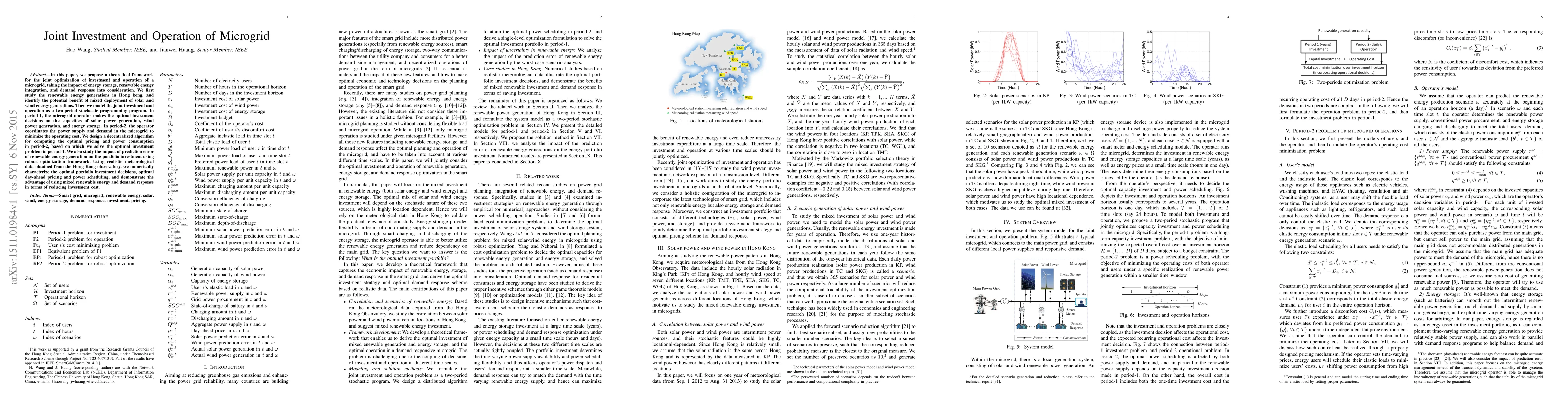

In this paper, we propose a theoretical framework for the joint optimization of investment and operation of a microgrid, taking the impact of energy storage, renewable energy integration, and demand response into consideration. We first study the renewable energy generations in Hong kong, and identify the potential benefit of mixed deployment of solar and wind energy generations. Then we model the joint investment and operation as a two-period stochastic programming program. In period-1, the microgrid operator makes the optimal investment decisions on the capacities of solar power generation, wind power generation, and energy storage. In period-2, the operator coordinates the power supply and demand in the microgrid to minimize the operating cost. We design a decentralized algorithm for computing the optimal pricing and power consumption in period-2, based on which we solve the optimal investment problem in period-1. We also study the impact of prediction error of renewable energy generation on the portfolio investment using robust optimization framework. Using realistic meteorological data obtained from the Hong Kong observatory, we numerically characterize the optimal portfolio investment decisions, optimal day-ahead pricing and power scheduling, and demonstrate the advantage of using mixed renewable energy and demand response in terms of reducing investment cost.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMicrogrid Operation Control with Adaptable Droop Gains

C. A. Hans, D. Schulz, E. D. Gomez Anccas

Impact of Cyber Failures on Operation and Adequacy of Multi-Microgrid Distribution Systems

Vijay Venu Vadlamudi, Mostafa Barani, Hossein Farzin

| Title | Authors | Year | Actions |

|---|

Comments (0)