Summary

Many complex systems generate multifractal time series which are long-range cross-correlated. Numerous methods have been proposed to characterize the multifractal nature of these long-range cross correlations. However, several important issues about these methods are not well understood and most methods consider only one moment order. We study the joint multifractal analysis based on partition function with two moment orders, which was initially invented to investigate fluid fields, and derive analytically several important properties. We apply the method numerically to binomial measures with multifractal cross correlations and bivariate fractional Brownian motions without multifractal cross correlations. For binomial multifractal measures, the explicit expressions of mass function, singularity strength and multifractal spectrum of the cross correlations are derived, which agree excellently with the numerical results. We also apply the method to stock market indexes and unveil intriguing multifractality in the cross correlations of index volatilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

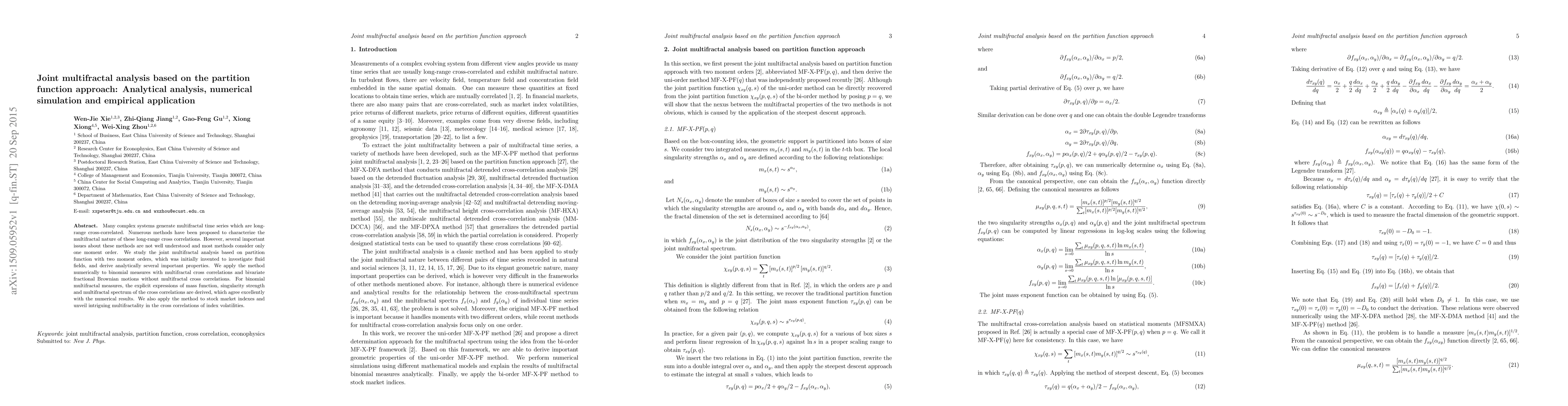

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)