Summary

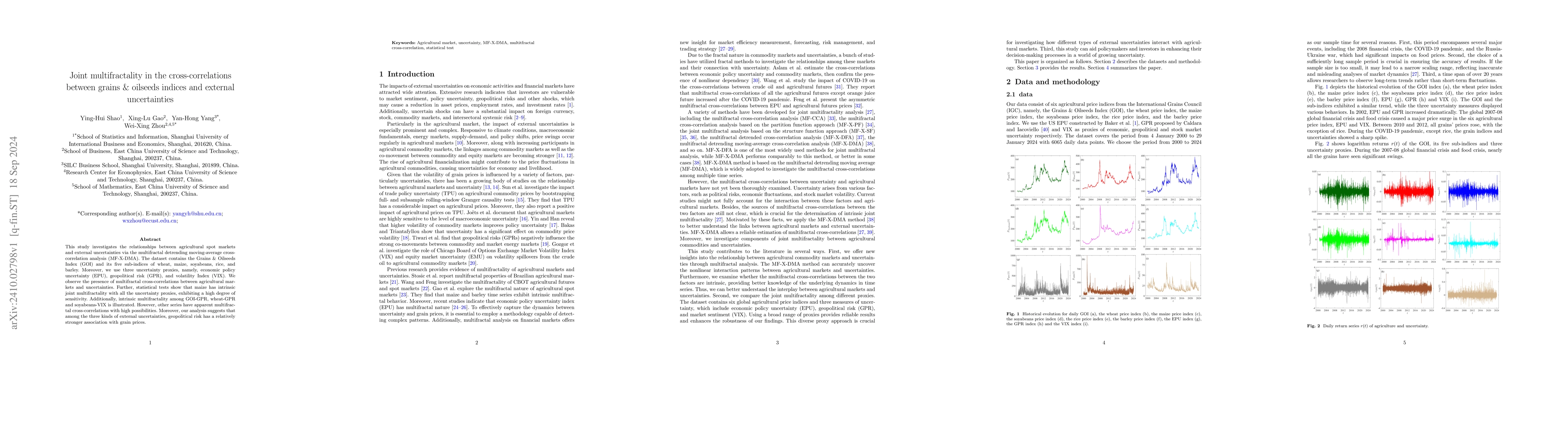

This study investigates the relationships between agricultural spot markets and external uncertainties via the multifractal detrending moving-average cross-correlation analysis (MF-X-DMA). The dataset contains the Grains \& Oilseeds Index (GOI) and its five sub-indices of wheat, maize, soyabeans, rice, and barley. Moreover, we use three uncertainty proxies, namely, economic policy uncertainty (EPU), geopolitical risk (GPR), and volatility Index (VIX). We observe the presence of multifractal cross-correlations between agricultural markets and uncertainties. Further, statistical tests show that maize has intrinsic joint multifractality with all the uncertainty proxies, exhibiting a high degree of sensitivity. Additionally, intrinsic multifractality among GOI-GPR, wheat-GPR and soyabeans-VIX is illustrated. However, other series have apparent multifractal cross-correlations with high possibilities. Moreover, our analysis suggests that among the three kinds of external uncertainties, geopolitical risk has a relatively stronger association with grain prices.

AI Key Findings

Generated Sep 03, 2025

Methodology

This study employs the multifractal detrending moving-average cross-correlation analysis (MF-X-DMA) to investigate relationships between agricultural spot markets and external uncertainties using the Grains & Oilseeds Index (GOI) and its sub-indices along with economic policy uncertainty (EPU), geopolitical risk (GPR), and volatility Index (VIX).

Key Results

- Multifractal cross-correlations are observed between agricultural markets and uncertainties.

- Maize exhibits intrinsic joint multifractality with all uncertainty proxies, indicating high sensitivity.

- Intrinsic multifractality is shown among GOI-GPR, wheat-GPR, and soyabeans-VIX.

- Geopolitical risk (GPR) has a relatively stronger association with grain prices compared to EPU and VIX.

- Weak multifractal cross-correlations are found in GOI, wheat, and soyabeans with EPU, while rice and barley show such correlations with GPR.

Significance

This research is crucial for understanding the complex dynamics between agricultural markets and external uncertainties, providing insights for policymakers, investors, and traders to make informed decisions.

Technical Contribution

The application of MF-X-DMA to analyze cross-correlations between agricultural indices and uncertainty proxies provides a novel approach to understanding complex market dynamics.

Novelty

This work distinguishes itself by applying multifractal analysis to agricultural indices, revealing the intrinsic and apparent multifractal cross-correlations with various uncertainty proxies, which hasn't been extensively explored in previous literature.

Limitations

- The study is limited to daily data from 2000 to 2024, which might not capture short-term or long-term extreme events.

- It focuses on specific uncertainty proxies (EPU, GPR, VIX) and may not account for other relevant factors influencing agricultural markets.

Future Work

- Further research could explore additional uncertainty proxies and their impact on agricultural markets.

- Investigating the effects of specific geopolitical events on grain prices using this methodology could be beneficial.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVisibility graph analysis of the grains and oilseeds indices

Wei-Xing Zhou, Hao-Ran Liu, Ming-Xia Li

Testing for intrinsic multifractality in the global grain spot market indices: A multifractal detrended fluctuation analysis

Li Wang, Wei-Xing Zhou, Xing-Lu Gao

No citations found for this paper.

Comments (0)