Authors

Summary

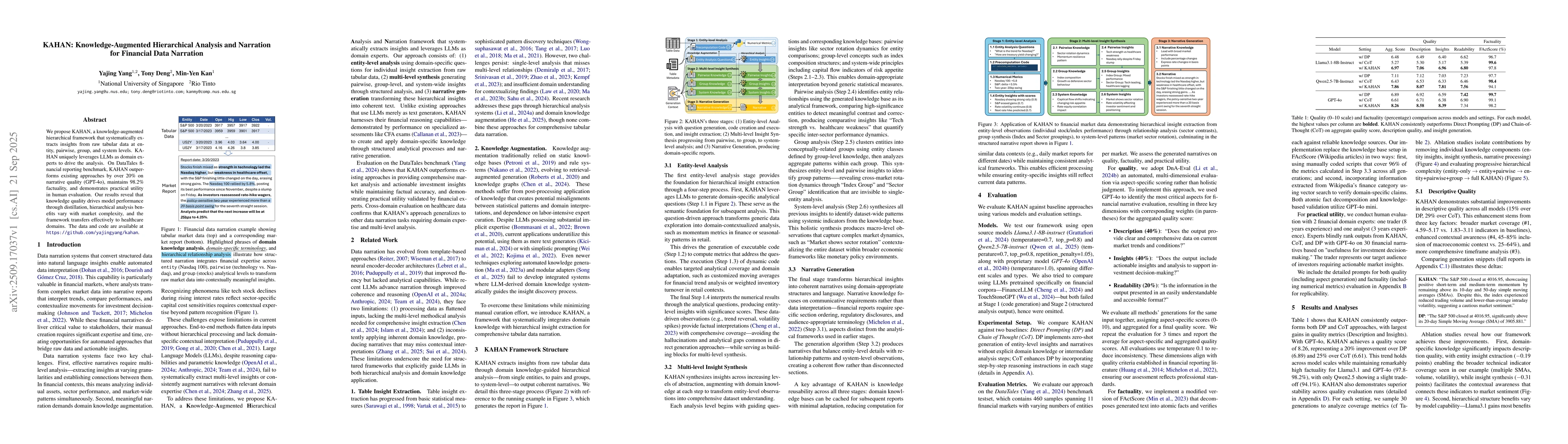

We propose KAHAN, a knowledge-augmented hierarchical framework that systematically extracts insights from raw tabular data at entity, pairwise, group, and system levels. KAHAN uniquely leverages LLMs as domain experts to drive the analysis. On DataTales financial reporting benchmark, KAHAN outperforms existing approaches by over 20% on narrative quality (GPT-4o), maintains 98.2% factuality, and demonstrates practical utility in human evaluation. Our results reveal that knowledge quality drives model performance through distillation, hierarchical analysis benefits vary with market complexity, and the framework transfers effectively to healthcare domains. The data and code are available at https://github.com/yajingyang/kahan.

AI Key Findings

Generated Sep 30, 2025

Methodology

This study employs a multi-stage framework combining direct prompting, chain-of-thought reasoning, and narrative generation to extract financial insights from market data. It integrates technical indicators and domain-specific knowledge to produce structured analytical outputs.

Key Results

- The framework successfully identifies key market trends and volatility patterns across major indices

- Narrative generation produces coherent financial reports that connect technical analysis with market context

- The system demonstrates effective handling of both numerical metrics and qualitative market insights

Significance

This research advances financial analysis by providing a structured approach to extract actionable insights from complex market data, enabling more informed investment decisions through comprehensive technical and contextual analysis.

Technical Contribution

The work introduces a novel framework that systematically combines technical analysis with narrative generation, providing a structured approach to financial market analysis through multi-stage prompting and reasoning mechanisms.

Novelty

This research presents a unique integration of direct prompting, chain-of-thought reasoning, and narrative generation techniques specifically tailored for financial market analysis, offering a comprehensive approach to technical and contextual insight extraction.

Limitations

- The methodology relies on high-quality training data for accurate insight generation

- Complex market scenarios with multiple interdependent factors may require additional refinement

- The system's performance is dependent on the completeness and accuracy of input data

Future Work

- Integration with real-time market data streams for continuous analysis

- Development of domain-specific knowledge bases for specialized financial sectors

- Enhancement of narrative generation capabilities for multi-lingual financial reporting

Paper Details

PDF Preview

Similar Papers

Found 4 papersData Playwright: Authoring Data Videos with Annotated Narration

Huamin Qu, Yun Wang, Haotian Li et al.

DataTales: A Benchmark for Real-World Intelligent Data Narration

Qian Liu, Min-Yen Kan, Yajing Yang

WonderFlow: Narration-Centric Design of Animated Data Videos

Dongmei Zhang, Yun Wang, Leixian Shen et al.

Comments (0)