Summary

Using introduced concept of the exchange and inflation rates adequacy, the relevance of them to the determining factors is found. We established close positive relation between hryvnia / dollar exchange and inflation rates, fiscal deficit, price level of energy sources, and money supply. On this basis, we give proposals for state macroeconomic policy to stabilize Ukrainian economy.

AI Key Findings

Generated Jun 10, 2025

Methodology

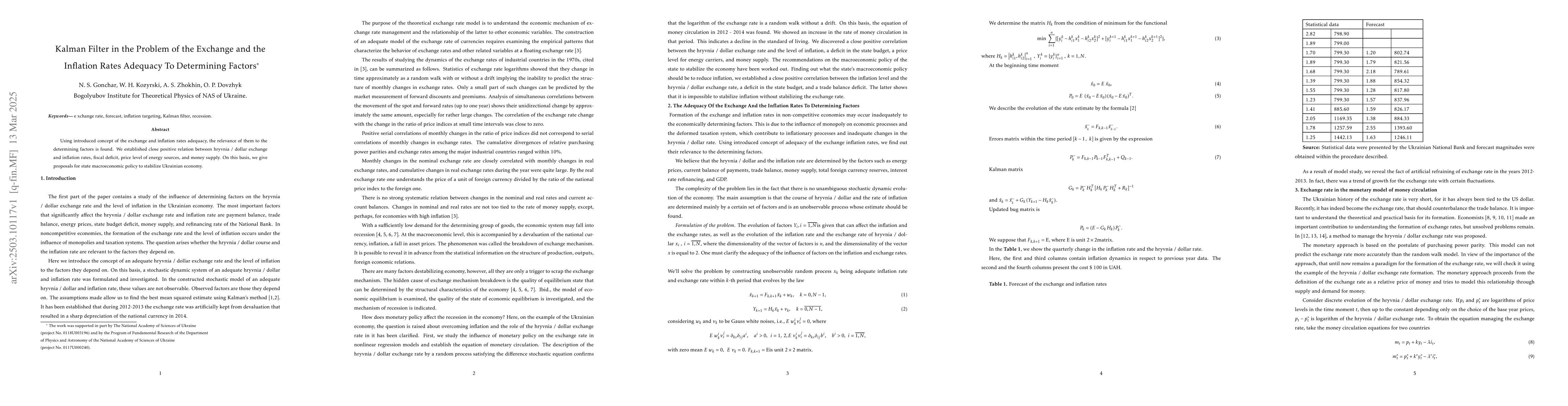

The paper applies the Kalman filter to analyze the relationship between exchange and inflation rates in the Ukrainian economy, using statistical data from 2012-2014.

Key Results

- A stochastic difference equation describing the hryvnia/dollar exchange rate evolution was established.

- The rate of money circulation showed a growing dynamic, indicating a fall in the standard of living.

- A close positive correlation was found between the hryvnia/dollar exchange rate, inflation, state budget deficit, energy prices, and money supply.

Significance

This research is important for understanding the factors influencing exchange and inflation rates in the Ukrainian economy, providing a basis for proposing state macroeconomic policies to stabilize the economy.

Technical Contribution

The paper presents a novel application of the Kalman filter to model and analyze the exchange and inflation rates in the Ukrainian economy, providing a stochastic difference equation and regression equations for forecasting.

Novelty

This work differs from existing research by applying the Kalman filter to determine the adequacy of exchange and inflation rates concerning their determining factors, offering specific policy recommendations for stabilizing the Ukrainian economy.

Limitations

- The study is limited to the Ukrainian context and may not be generalizable to other economies.

- Reliance on historical data might not fully capture future economic dynamics.

Future Work

- Further research could explore the application of this model to other economies or different time periods.

- Investigating the impact of additional economic factors on exchange and inflation rates could be valuable.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)