Summary

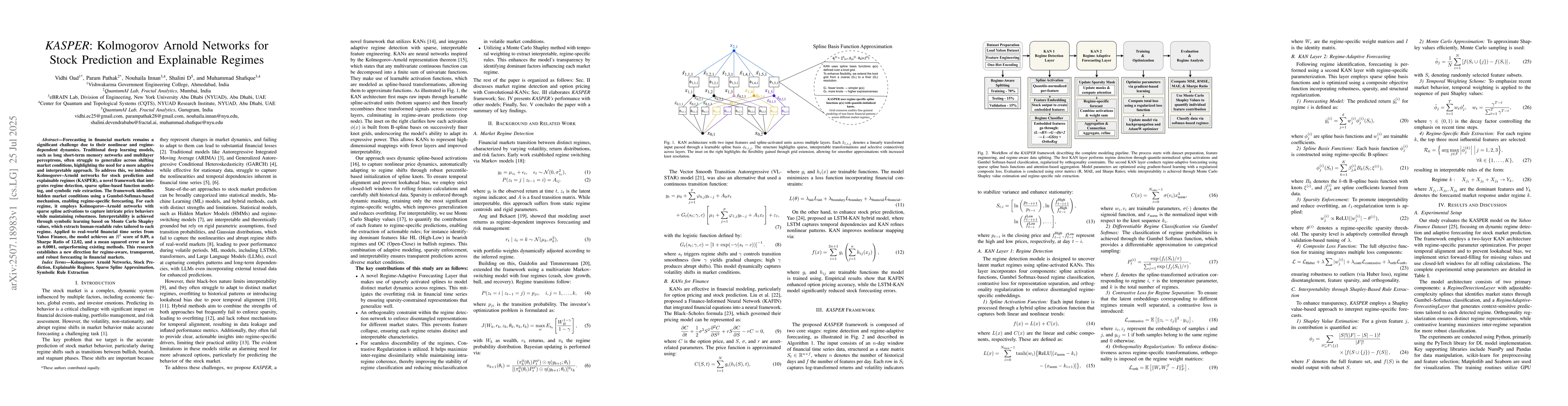

Forecasting in financial markets remains a significant challenge due to their nonlinear and regime-dependent dynamics. Traditional deep learning models, such as long short-term memory networks and multilayer perceptrons, often struggle to generalize across shifting market conditions, highlighting the need for a more adaptive and interpretable approach. To address this, we introduce Kolmogorov-Arnold networks for stock prediction and explainable regimes (KASPER), a novel framework that integrates regime detection, sparse spline-based function modeling, and symbolic rule extraction. The framework identifies hidden market conditions using a Gumbel-Softmax-based mechanism, enabling regime-specific forecasting. For each regime, it employs Kolmogorov-Arnold networks with sparse spline activations to capture intricate price behaviors while maintaining robustness. Interpretability is achieved through symbolic learning based on Monte Carlo Shapley values, which extracts human-readable rules tailored to each regime. Applied to real-world financial time series from Yahoo Finance, the model achieves an $R^2$ score of 0.89, a Sharpe Ratio of 12.02, and a mean squared error as low as 0.0001, outperforming existing methods. This research establishes a new direction for regime-aware, transparent, and robust forecasting in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConvolutional Kolmogorov-Arnold Networks

Alexander Dylan Bodner, Antonio Santiago Tepsich, Jack Natan Spolski et al.

PIKAN: Physics-Inspired Kolmogorov-Arnold Networks for Explainable UAV Channel Modelling

Antoine Lesage-Landry, Güneş Karabulut Kurt, Kürşat Tekbıyık

Explainable fault and severity classification for rolling element bearings using Kolmogorov-Arnold networks

Spyros Rigas, Michalis Papachristou, Georgios Alexandridis et al.

No citations found for this paper.

Comments (0)