Summary

Two-sample and independence tests with the kernel-based MMD and HSIC have shown remarkable results on i.i.d. data and stationary random processes. However, these statistics are not directly applicable to non-stationary random processes, a prevalent form of data in many scientific disciplines. In this work, we extend the application of MMD and HSIC to non-stationary settings by assuming access to independent realisations of the underlying random process. These realisations - in the form of non-stationary time-series measured on the same temporal grid - can then be viewed as i.i.d. samples from a multivariate probability distribution, to which MMD and HSIC can be applied. We further show how to choose suitable kernels over these high-dimensional spaces by maximising the estimated test power with respect to the kernel hyper-parameters. In experiments on synthetic data, we demonstrate superior performance of our proposed approaches in terms of test power when compared to current state-of-the-art functional or multivariate two-sample and independence tests. Finally, we employ our methods on a real socio-economic dataset as an example application.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

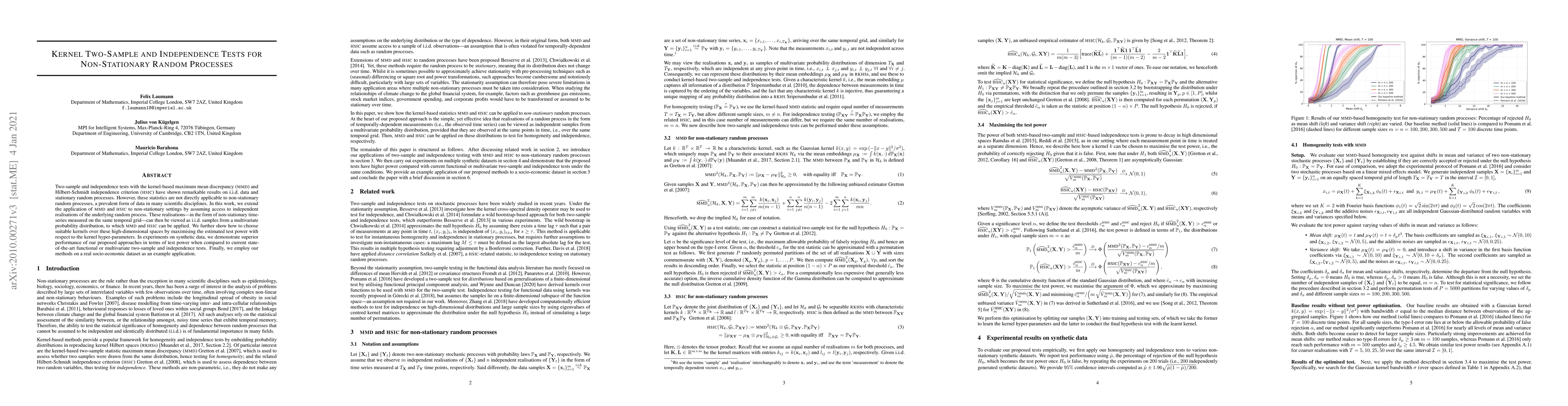

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKernel-based Joint Independence Tests for Multivariate Stationary and Non-stationary Time Series

Mauricio Barahona, Zhaolu Liu, Robert L. Peach et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)