Authors

Summary

This paper examines the recent reform of Morocco's public procurement market through the lens of Keynesian beauty contest theory. The reform introduces a mechanism akin to a guessing-the-average game, where bidders attempt to estimate a reference price, which in turn impacts bidding strategies. We utilize this setup to empirically test key hypotheses within auction theory, specifically the roles of common knowledge and bounded rationality. Our findings indicate potential manipulation risks under the current rules, suggesting that a shift to a median criterion could improve robustness and reduce the likelihood of manipulation. This work contributes to the broader understanding of strategic interactions in procurement and offers a foundation for future research on improving fairness and efficiency in public contract allocation.

AI Key Findings

Generated Jun 10, 2025

Methodology

This research applies Keynesian beauty contest theory to analyze Morocco's public procurement reform, focusing on bidders' strategies and the potential for manipulation. It uses auction theory to empirically test hypotheses on common knowledge and bounded rationality.

Key Results

- The reform introduces a mechanism akin to a guessing-the-average game, where bidders attempt to estimate a reference price, impacting bidding strategies.

- Findings indicate potential manipulation risks under the current rules, suggesting a shift to a median criterion could improve robustness and reduce manipulation likelihood.

- Empirical evidence shows bidders generally do not extend their reasoning beyond levels three or four, challenging the common knowledge assumption.

Significance

This work contributes to understanding strategic interactions in procurement and offers a foundation for improving fairness and efficiency in public contract allocation.

Technical Contribution

The paper proposes using the median as an alternative to the mean in reference price formulation to mitigate sensitivity to extreme data, contributing to auction theory and public procurement literature.

Novelty

This research challenges the common knowledge assumption in auction theory by examining the 'reference price guessing game' in Morocco's public procurement reform, offering new insights into sealed auction dynamics.

Limitations

- The dataset is limited to 12 Moroccan public procurement tenders, restricting broader conclusions about bidding behavior over time.

- The analysis is based on a specific regulatory context, which may limit generalizability to other environments.

Future Work

- Investigate the dynamics of learning in repeated bids using longitudinal data.

- Explore coalition formation further, especially in different regulatory contexts or industries.

Paper Details

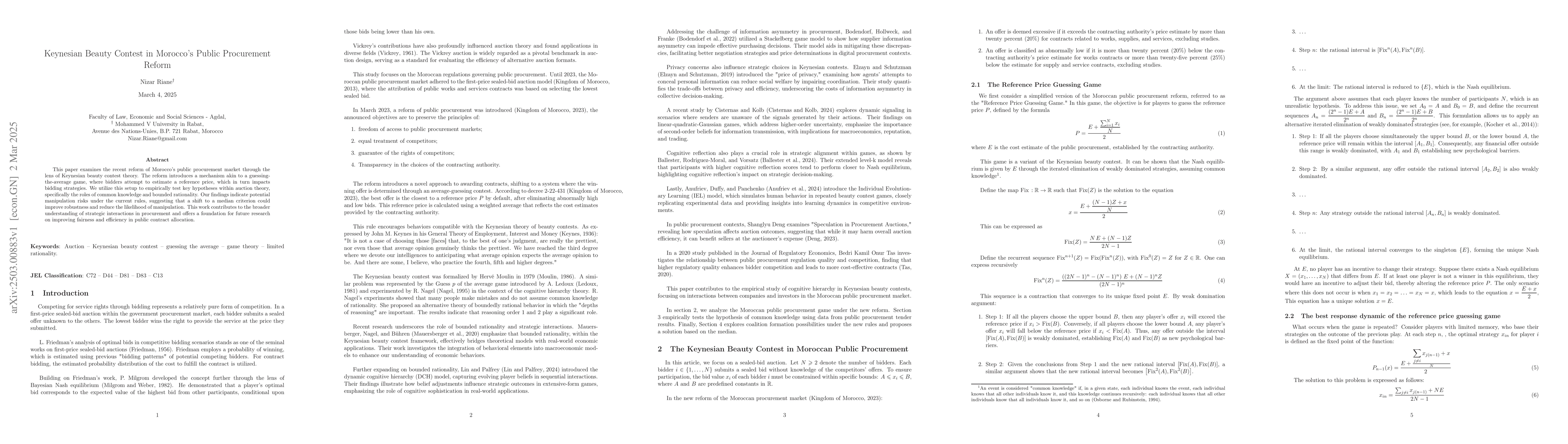

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)