Authors

Summary

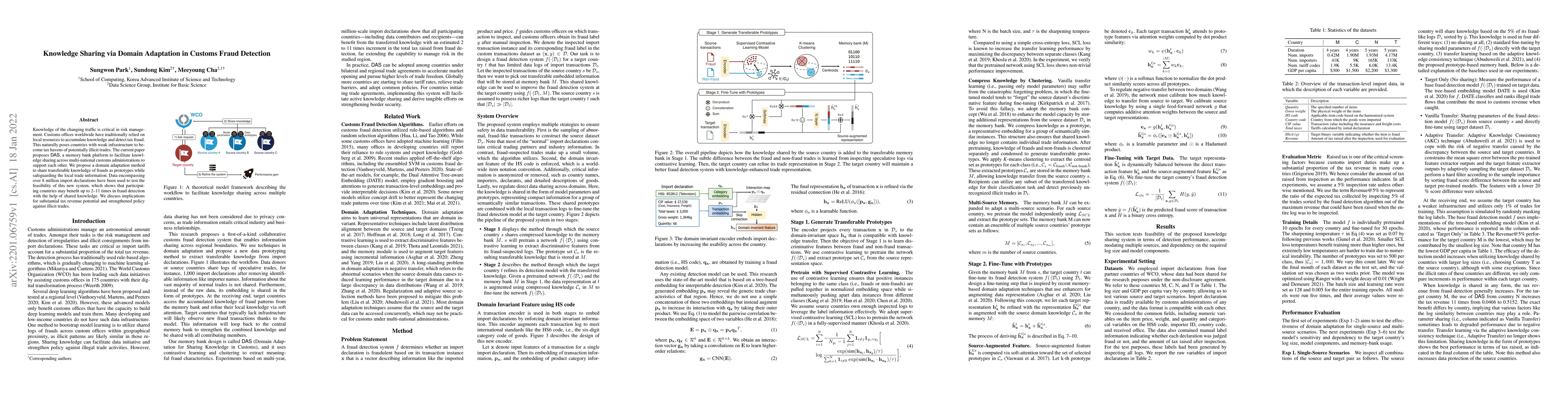

Knowledge of the changing traffic is critical in risk management. Customs offices worldwide have traditionally relied on local resources to accumulate knowledge and detect tax fraud. This naturally poses countries with weak infrastructure to become tax havens of potentially illicit trades. The current paper proposes DAS, a memory bank platform to facilitate knowledge sharing across multi-national customs administrations to support each other. We propose a domain adaptation method to share transferable knowledge of frauds as prototypes while safeguarding the local trade information. Data encompassing over 8 million import declarations have been used to test the feasibility of this new system, which shows that participating countries may benefit up to 2-11 times in fraud detection with the help of shared knowledge. We discuss implications for substantial tax revenue potential and strengthened policy against illicit trades.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGraphFC: Customs Fraud Detection with Label Scarcity

Shou-De Lin, Meeyoung Cha, Cheng-Te Li et al.

Customs Fraud Detection in the Presence of Concept Drift

Sundong Kim, Aitolkyn Baigutanova, Tung-Duong Mai et al.

Knowledge-inspired Subdomain Adaptation for Cross-Domain Knowledge Transfer

Shuai Chen, Weiqiang Wang, Qiyu Li et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)