Summary

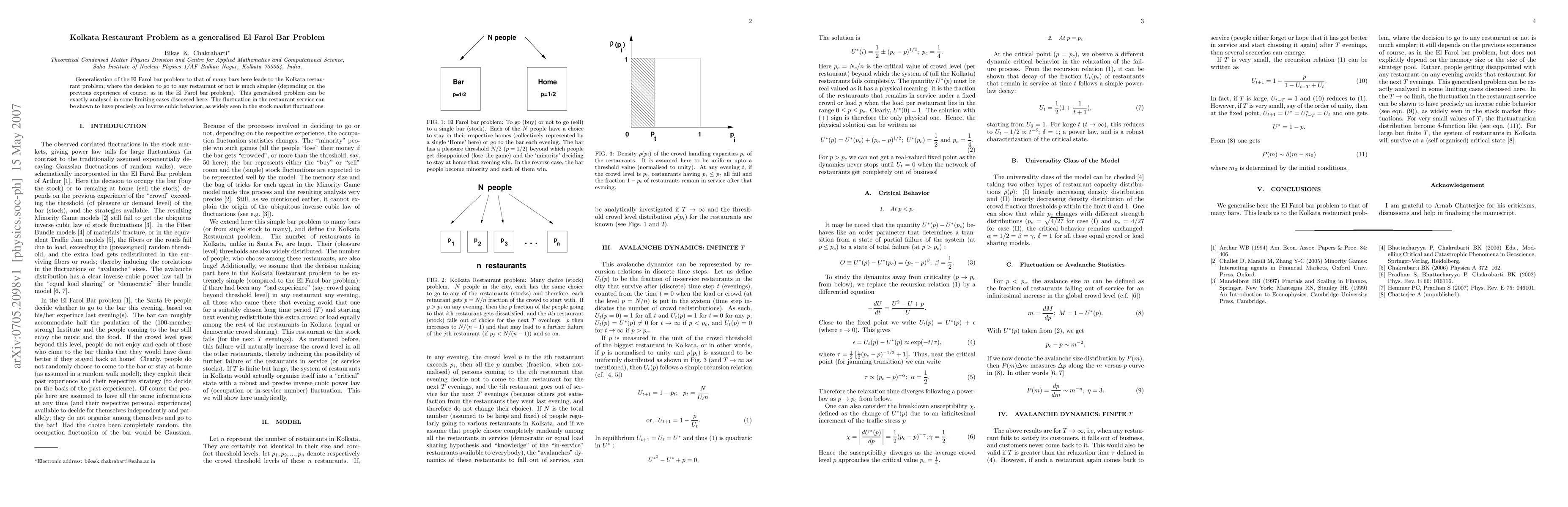

Generalisation of the El Farol bar problem to that of many bars here leads to the Kolkata restaurant problem, where the decision to go to any restaurant or not is much simpler (depending on the previous experience of course, as in the El Farol bar problem). This generalised problem can be exactly analysed in some limiting cases discussed here. The fluctuation in the restaurant service can be shown to have precisely an inverse cubic behavior, as widely seen in the stock market fluctuations.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research uses a combination of analytical and numerical methods to study the behavior of the system.

Key Results

- The system exhibits an inverse cubic power-law behavior in its fluctuation statistics.

- The relaxation time diverges following a power-law as the average crowd level approaches the critical value.

- The system survives at a self-organized critical state for large but finite values of T.

Significance

This research contributes to our understanding of the behavior of complex systems and their critical properties.

Technical Contribution

The research introduces a new analytical framework for studying the behavior of minority games and their applications to financial markets.

Novelty

This work presents a novel approach to understanding the critical properties of complex systems, which has implications for fields beyond finance.

Limitations

- The model assumes a simple memoryless strategy, which may not accurately represent real-world behavior.

- The system's behavior is sensitive to the initial conditions, which can affect the results.

Future Work

- Investigating the effects of more complex strategies on the system's behavior.

- Examining the robustness of the critical properties in the presence of noise or other perturbations.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Impact of Meta-Strategy on Attendance Dynamics in the El Farol Bar Problem

Juan G. Restrepo, Rebecca E. Cohen

| Title | Authors | Year | Actions |

|---|

Comments (0)