Summary

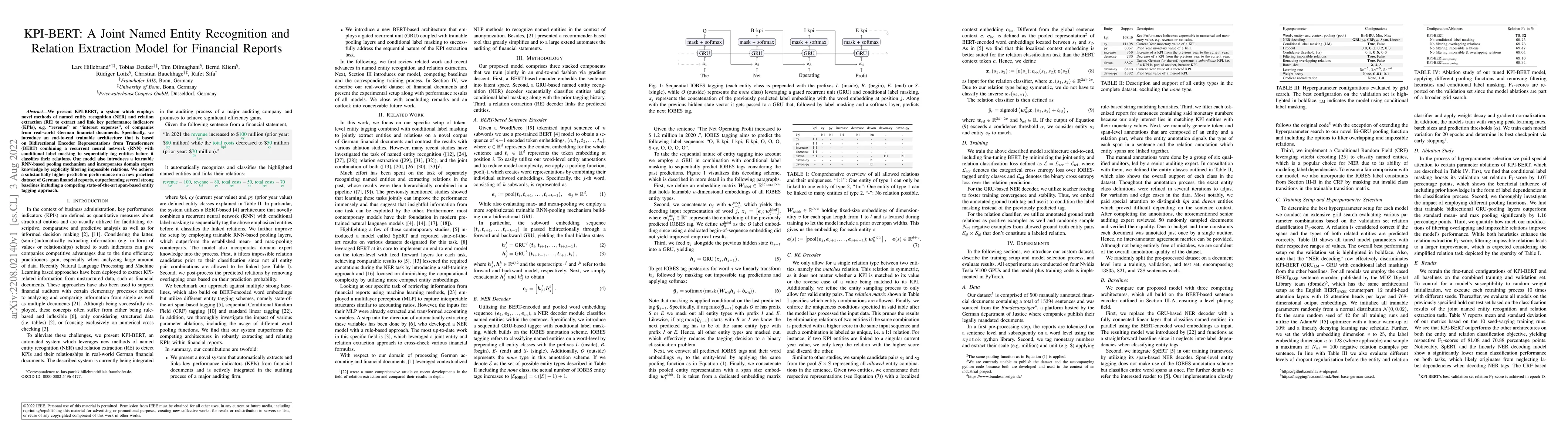

We present KPI-BERT, a system which employs novel methods of named entity recognition (NER) and relation extraction (RE) to extract and link key performance indicators (KPIs), e.g. "revenue" or "interest expenses", of companies from real-world German financial documents. Specifically, we introduce an end-to-end trainable architecture that is based on Bidirectional Encoder Representations from Transformers (BERT) combining a recurrent neural network (RNN) with conditional label masking to sequentially tag entities before it classifies their relations. Our model also introduces a learnable RNN-based pooling mechanism and incorporates domain expert knowledge by explicitly filtering impossible relations. We achieve a substantially higher prediction performance on a new practical dataset of German financial reports, outperforming several strong baselines including a competing state-of-the-art span-based entity tagging approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersKPI-EDGAR: A Novel Dataset and Accompanying Metric for Relation Extraction from Financial Documents

Lars Hillebrand, Christian Bauckhage, Rafet Sifa et al.

German BERT Model for Legal Named Entity Recognition

Harshil Darji, Michael Granitzer, Jelena Mitrović

| Title | Authors | Year | Actions |

|---|

Comments (0)