Summary

In this paper we study the Kyle-Back strategic insider trading equilibrium model in which the insider has an instantaneous information on an asset, assumed to follow an Ornstein-Uhlenback-type dynamics that allows possible influence by the market price. Such a model exhibits some further interplay between insider's information and the market price, and it is the first time being put into a rigorous mathematical framework of the recently developed {\it conditional mean-field} stochastic differential equation (CMFSDEs). With the help of the "reference probability measure" concept in filtering theory, we shall first prove a general well-posedness result for a class of linear CMFSDEs, which is new in the literature of both filtering theory and mean-field SDEs, and will be the foundation for the underlying strategic equilibrium model. Assuming some further Gaussian structures of the model, we find a closed form of optimal intensity of trading strategy as well as the dynamic pricing rules. We shall also substantiate the well-posedness of the resulting optimal closed-loop system, whence the existence of Kyle-Back equilibrium. Our result recovers many existing results as special cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

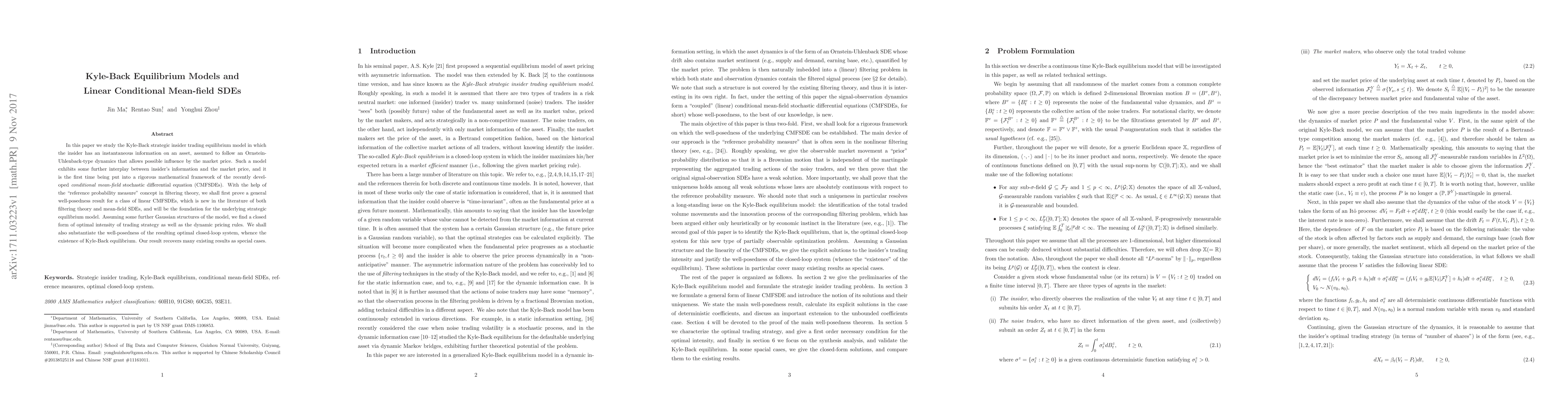

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA New Approach for the Continuous Time Kyle-Back Strategic Insider Equilibrium Problem

Jianfeng Zhang, Bixing Qiao

| Title | Authors | Year | Actions |

|---|

Comments (0)