Authors

Summary

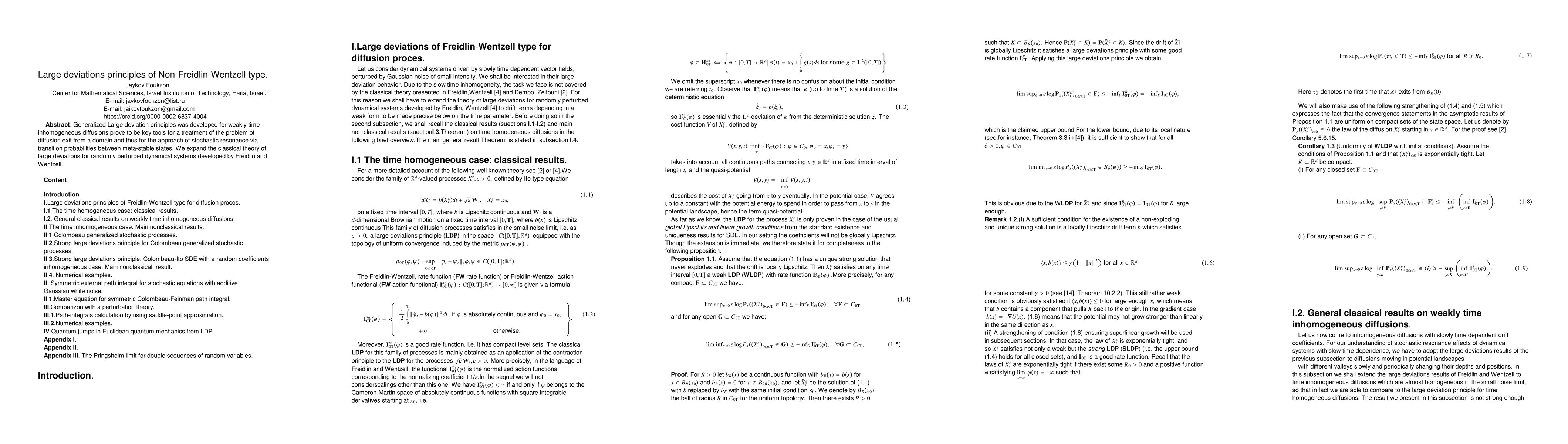

Generalized Large deviation principles was developed for Colombeau-Ito SDE with a random coefficients. We is significantly expand the classical theory of large deviations for randomly perturbed dynamical systems developed by Freidlin and Wentzell.Using SLDP approach, jumps phenomena, in financial markets, also is considered. Jumps phenomena, in financial markets is explained from the first principles, without any reference to Poisson jump process. In contrast with a phenomenological approach we explain such jumps phenomena from the first principles, without any reference to Poisson jump process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBridging Freidlin-Wentzell large deviations theory and stochastic thermodynamics

Massimiliano Esposito, Gianmaria Falasco, Nahuel Freitas et al.

Large deviations for diffusions: Donsker-Varadhan meet Freidlin-Wentzell

Davide Gabrielli, Lorenzo Bertini, Claudio Landim

| Title | Authors | Year | Actions |

|---|

Comments (0)