Summary

The probability minimizing problem of large losses of portfolio in discrete and continuous time models is studied. This gives a generalization of quantile hedging presented in [3].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

continuous time

(0.378)

losses

(0.378)

continuous time

(0.374)

losses

(0.364)

minimizing

(0.360)

minimizing

(0.358)

gives

(0.294)

gives

(0.282)

Citation Network

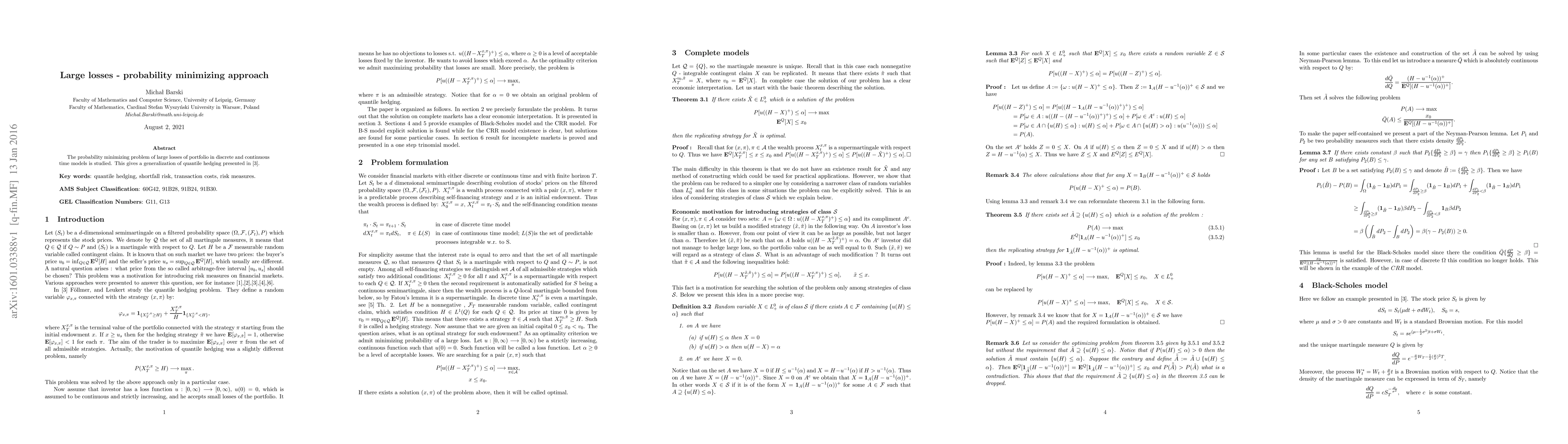

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Current Paper

Citations

References

Click to view

Similar Papers

Found 4 papersOptimal Compression for Minimizing Classification Error Probability: an Information-Theoretic Approach

Jingchao Gao, Weiyu Xu, Ao Tang

No citations found for this paper.

Comments (0)