Summary

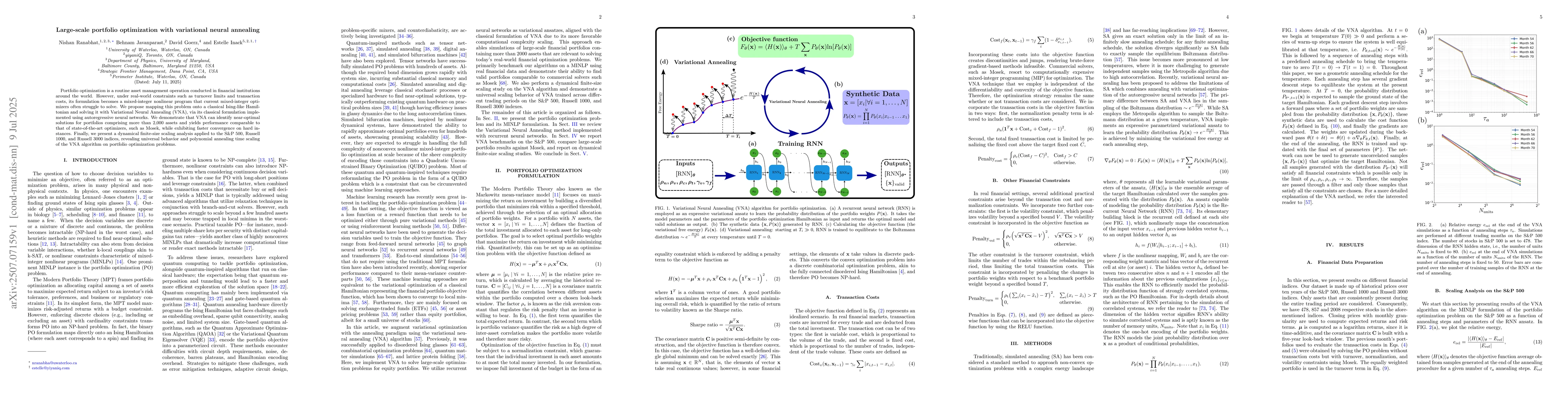

Portfolio optimization is a routine asset management operation conducted in financial institutions around the world. However, under real-world constraints such as turnover limits and transaction costs, its formulation becomes a mixed-integer nonlinear program that current mixed-integer optimizers often struggle to solve. We propose mapping this problem onto a classical Ising-like Hamiltonian and solving it with Variational Neural Annealing (VNA), via its classical formulation implemented using autoregressive neural networks. We demonstrate that VNA can identify near-optimal solutions for portfolios comprising more than 2,000 assets and yields performance comparable to that of state-of-the-art optimizers, such as Mosek, while exhibiting faster convergence on hard instances. Finally, we present a dynamical finite-size scaling analysis applied to the S&P 500, Russell 1000, and Russell 3000 indices, revealing universal behavior and polynomial annealing time scaling of the VNA algorithm on portfolio optimization problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio optimization with discrete simulated annealing

Juan José García-Ripoll, Diego Porras, Álvaro Rubio-García

On Accelerating Large-Scale Robust Portfolio Optimization

Chung-Han Hsieh, Jie-Ling Lu

End-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

No citations found for this paper.

Comments (0)