Summary

We revisit the Bayesian Black-Litterman (BL) portfolio model and remove its reliance on subjective investor views. Classical BL requires an investor "view": a forecast vector $q$ and its uncertainty matrix $\Omega$ that describe how much a chosen portfolio should outperform the market. Our key idea is to treat $(q,\Omega)$ as latent variables and learn them from market data within a single Bayesian network. Consequently, the resulting posterior estimation admits closed-form expression, enabling fast inference and stable portfolio weights. Building on these, we propose two mechanisms to capture how features interact with returns: shared-latent parametrization and feature-influenced views; both recover classical BL and Markowitz portfolios as special cases. Empirically, on 30-year Dow-Jones and 20-year sector-ETF data, we improve Sharpe ratios by 50% and cut turnover by 55% relative to Markowitz and the index baselines. This work turns BL into a fully data-driven, view-free, and coherent Bayesian framework for portfolio optimization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

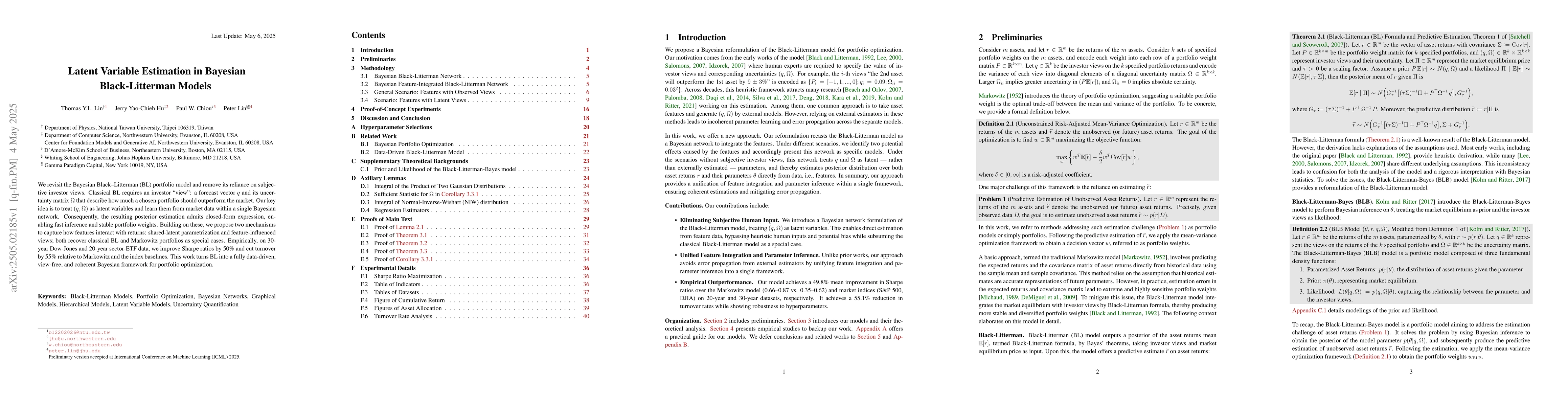

PDF Preview

Similar Papers

Found 4 papersBlack-Litterman, Bayesian Shrinkage, and Factor Models in Portfolio Selection: You Can Have It All

Kwong Yu Chong

Opaque prior distributions in Bayesian latent variable models

Edgar C. Merkle, Oludare Ariyo, Sonja D. Winter et al.

No citations found for this paper.

Comments (0)