Summary

This paper investigates the so-called leakage effect of trading strategies generated functionally from rank-dependent portfolio generating functions. This effect measures the loss in wealth of trading strategies due to renewing the portfolio constituent stocks. Theoretically, the leakage effect of a trading strategy is expressed explicitly by a finite-variation term. The computation of the leakage is different from what previous research has suggested. The method to estimate leakage in discrete time is then introduced with some practical considerations. An empirical example illustrates the leakage of the corresponding trading strategies under different constituent list sizes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

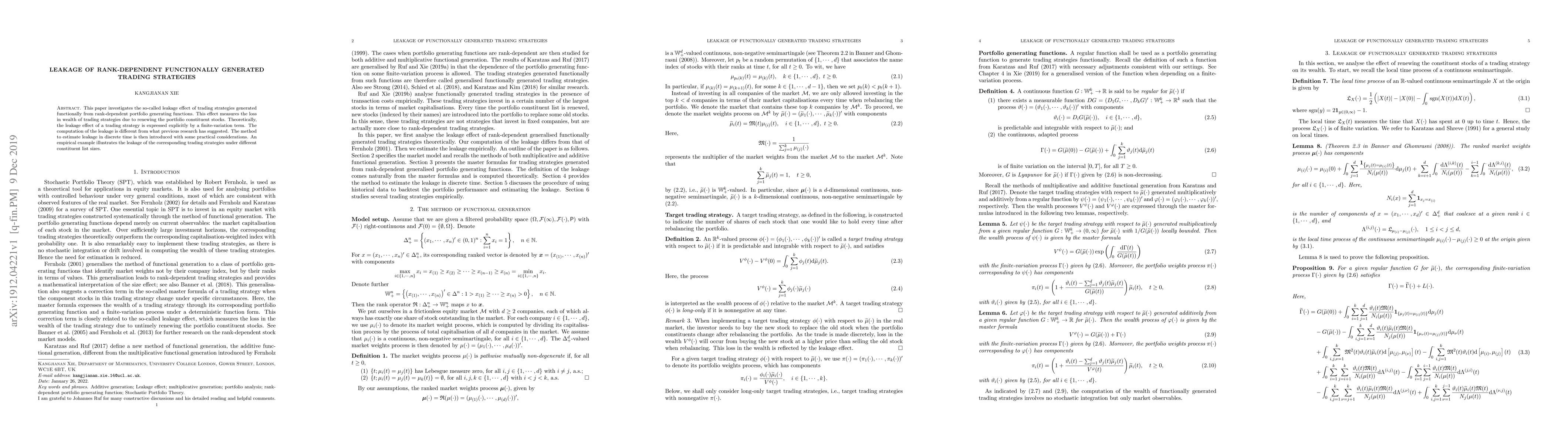

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)