Summary

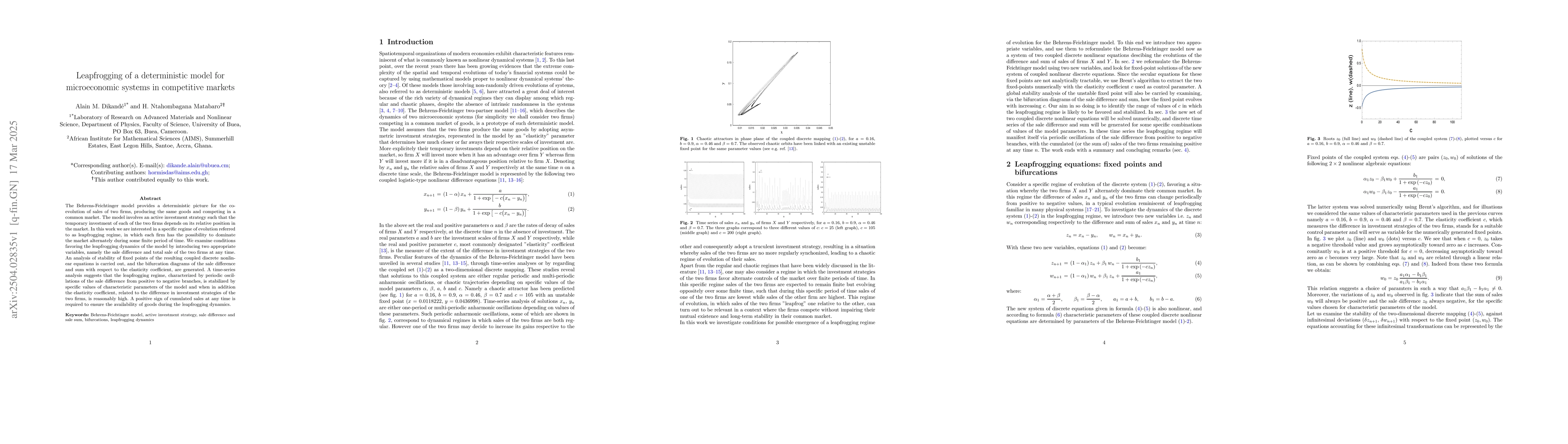

The Behrens-Feichtinger model provides a deterministic picture for the co-evolution of sales of two firms, producing the same goods and competing in a common market. The model involves an active investment strategy such that the temporary investment of each of the two firms depends on its relative position in the market. In this work we are interested in a specific regime of evolution referred to as leapfrogging regime, in which each firm has the possibility to dominate the market alternately during some finite period of time. We examine conditions favoring the leapfrogging dynamics of the model by introducing two appropriate variables, namely the sale difference and total sale of the two firms at any time. An analysis of stability of fixed points of the resulting coupled discrete nonlinear equations is carried out, and the bifurcation diagrams of the sale difference and sum with respect to the elasticity coefficient, are generated. A time-series analysis suggests that the leapfrogging regime, characterized by periodic oscillations of the sale difference from positive to negative branches, is stabilized by specific values of characteristic parameters of the model and when in addition the elasticity coefficient, related to the difference in investment strategies of the two firms, is reasonably high. A positive sign of cumulated sales at any time is required to ensure the availability of goods during the leapfrogging dynamics.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper employs a mathematical modeling approach, utilizing the Behrens-Feichtinger model to analyze the co-evolution of sales for two competing firms in a market.

Key Results

- The leapfrogging regime is identified, where firms alternate dominance in the market for a finite period.

- Fixed points of the discrete nonlinear equations are analyzed for stability, generating bifurcation diagrams for sale difference and sum.

- Leapfrogging dynamics are stabilized by specific parameter values and a high elasticity coefficient related to investment strategies.

Significance

This research contributes to understanding competitive market dynamics, providing insights into how firms' investment strategies can lead to alternating market dominance.

Technical Contribution

The introduction of sale difference and total sale variables to examine leapfrogging conditions in the Behrens-Feichtinger model.

Novelty

This work distinguishes itself by focusing on the leapfrogging regime in competitive markets, providing a novel perspective on firm investment strategies and market dominance.

Limitations

- The model assumes a deterministic approach, potentially overlooking stochastic elements in real-world markets.

- The analysis focuses on a two-firm system, which may not fully represent complex multi-firm market scenarios.

Future Work

- Investigate the impact of stochastic elements on leapfrogging dynamics.

- Extend the model to accommodate more than two firms to study multi-firm market competition.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)