Summary

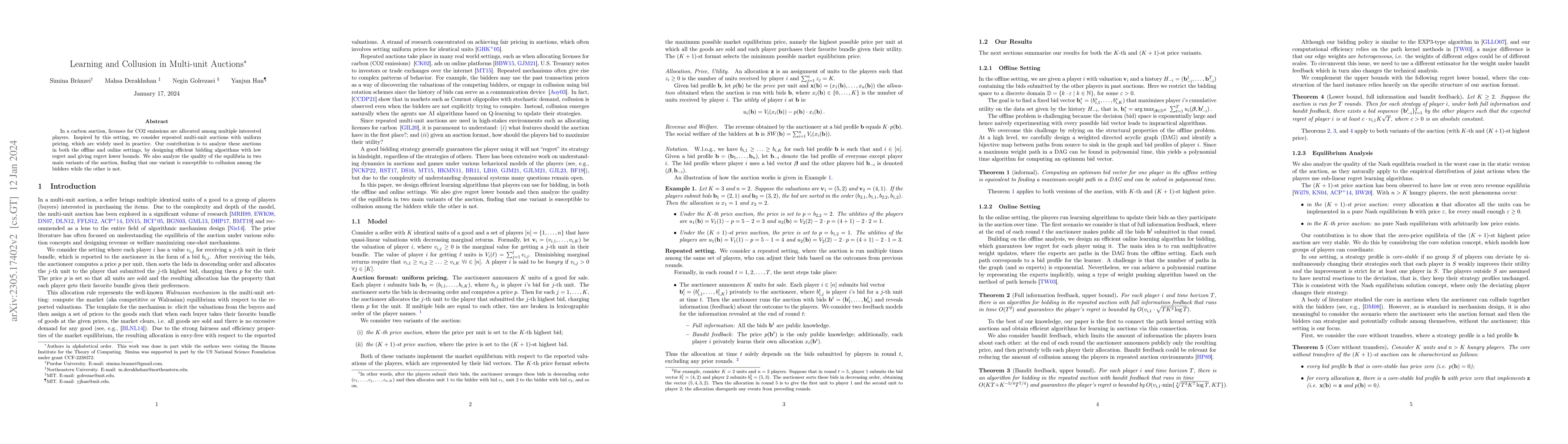

We consider repeated multi-unit auctions with uniform pricing, which are widely used in practice for allocating goods such as carbon licenses. In each round, $K$ identical units of a good are sold to a group of buyers that have valuations with diminishing marginal returns. The buyers submit bids for the units, and then a price $p$ is set per unit so that all the units are sold. We consider two variants of the auction, where the price is set to the $K$-th highest bid and $(K+1)$-st highest bid, respectively. We analyze the properties of this auction in both the offline and online settings. In the offline setting, we consider the problem that one player $i$ is facing: given access to a data set that contains the bids submitted by competitors in past auctions, find a bid vector that maximizes player $i$'s cumulative utility on the data set. We design a polynomial time algorithm for this problem, by showing it is equivalent to finding a maximum-weight path on a carefully constructed directed acyclic graph. In the online setting, the players run learning algorithms to update their bids as they participate in the auction over time. Based on our offline algorithm, we design efficient online learning algorithms for bidding. The algorithms have sublinear regret, under both full information and bandit feedback structures. We complement our online learning algorithms with regret lower bounds. Finally, we analyze the quality of the equilibria in the worst case through the lens of the core solution concept in the game among the bidders. We show that the $(K+1)$-st price format is susceptible to collusion among the bidders; meanwhile, the $K$-th price format does not have this issue.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning in Repeated Multi-Unit Pay-As-Bid Auctions

Negin Golrezaei, Rigel Galgana

Improved learning rates in multi-unit uniform price auctions

Cheng Wan, Vianney Perchet, Dorian Baudry et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)