Authors

Summary

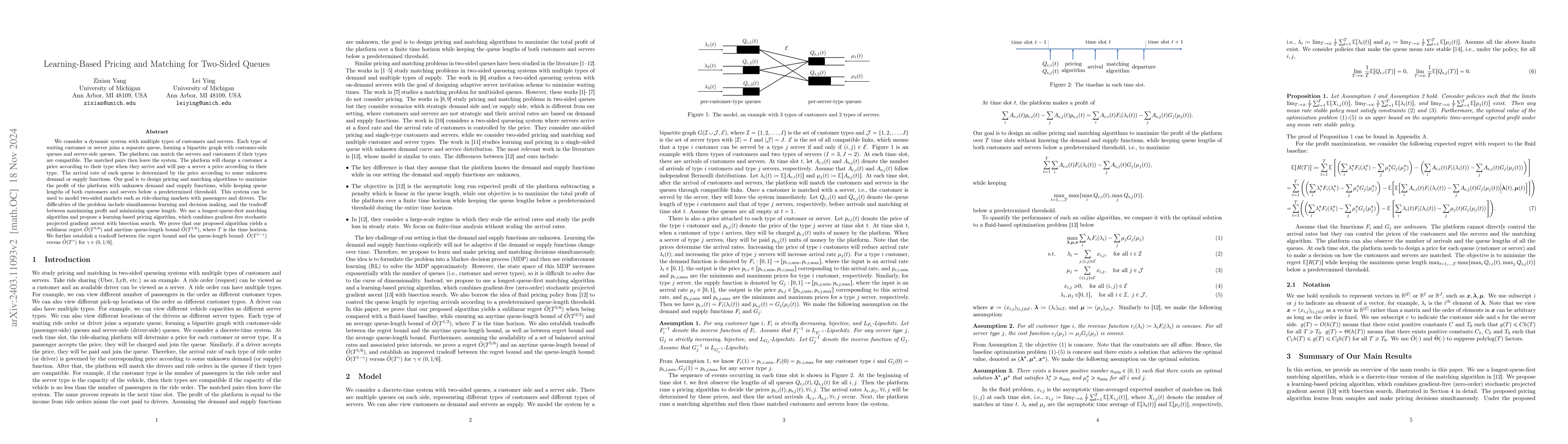

We consider a dynamic system with multiple types of customers and servers. Each type of waiting customer or server joins a separate queue, forming a bipartite graph with customer-side queues and server-side queues. The platform can match the servers and customers if their types are compatible. The matched pairs then leave the system. The platform will charge a customer a price according to their type when they arrive and will pay a server a price according to their type. The arrival rate of each queue is determined by the price according to some unknown demand or supply functions. Our goal is to design pricing and matching algorithms to maximize the profit of the platform with unknown demand and supply functions, while keeping queue lengths of both customers and servers below a predetermined threshold. This system can be used to model two-sided markets such as ride-sharing markets with passengers and drivers. The difficulties of the problem include simultaneous learning and decision making, and the tradeoff between maximizing profit and minimizing queue length. We use a longest-queue-first matching algorithm and propose a learning-based pricing algorithm, which combines gradient-free stochastic projected gradient ascent with bisection search. We prove that our proposed algorithm yields a sublinear regret $\tilde{O}(T^{5/6})$ and queue-length bound $\tilde{O}(T^{2/3})$, where $T$ is the time horizon. We further establish a tradeoff between the regret bound and the queue-length bound: $\tilde{O}(T^{1-\gamma/4})$ versus $\tilde{O}(T^{\gamma})$ for $\gamma \in (0, 2/3].$

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning for Two-Sided Matching

David C. Parkes, Sai Srivatsa Ravindranath, Zhe Feng et al.

Two-Sided Learning in Decentralized Matching Markets

Bryce L. Ferguson, Jason R. Marden, Vade Shah

No citations found for this paper.

Comments (0)