Summary

We present a methodology to robustly estimate the competitive equilibria (CE) of combinatorial markets under the assumption that buyers do not know their precise valuations for bundles of goods, but instead can only provide noisy estimates. We first show tight lower- and upper-bounds on the buyers' utility loss, and hence the set of CE, given a uniform approximation of one market by another. We then develop a learning framework for our setup, and present two probably-approximately-correct algorithms for learning CE, i.e., producing uniform approximations that preserve CE, with finite-sample guarantees. The first is a baseline that uses Hoeffding's inequality to produce a uniform approximation of buyers' valuations with high probability. The second leverages a connection between the first welfare theorem of economics and uniform approximations to adaptively prune value queries when it determines that they are provably not part of a CE. We experiment with our algorithms and find that the pruning algorithm achieves better estimates than the baseline with far fewer samples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

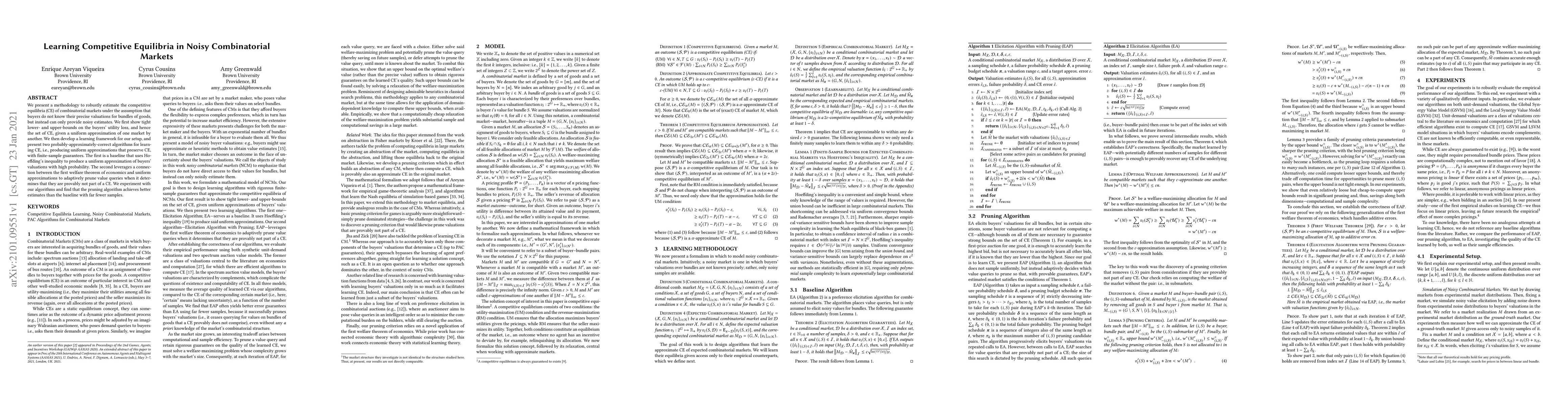

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)