Authors

Summary

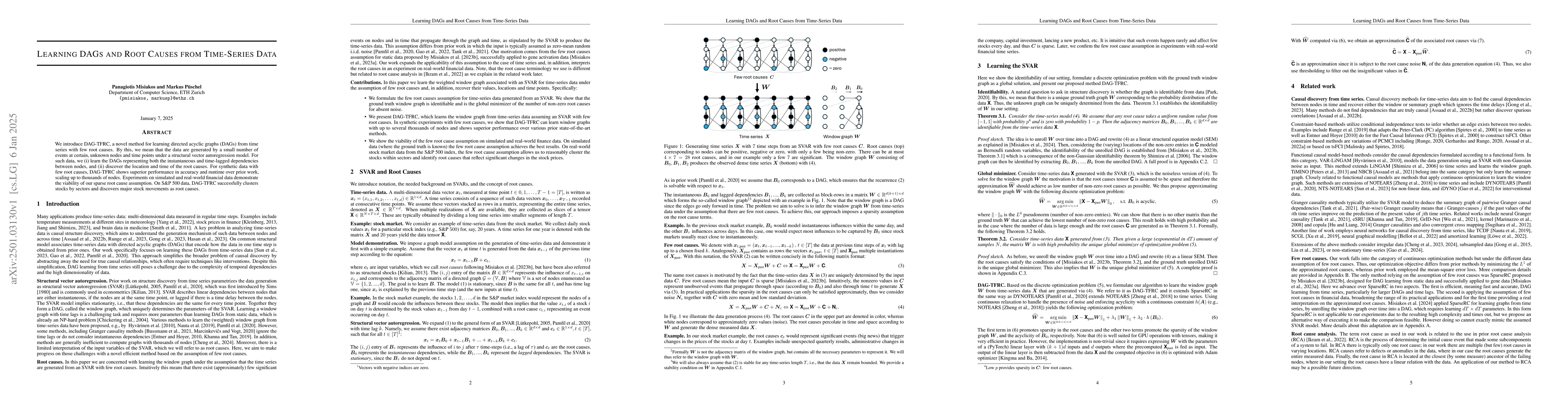

We introduce DAG-TFRC, a novel method for learning directed acyclic graphs (DAGs) from time series with few root causes. By this, we mean that the data are generated by a small number of events at certain, unknown nodes and time points under a structural vector autoregression model. For such data, we (i) learn the DAGs representing both the instantaneous and time-lagged dependencies between nodes, and (ii) discover the location and time of the root causes. For synthetic data with few root causes, DAG-TFRC shows superior performance in accuracy and runtime over prior work, scaling up to thousands of nodes. Experiments on simulated and real-world financial data demonstrate the viability of our sparse root cause assumption. On S&P 500 data, DAG-TFRC successfully clusters stocks by sectors and discovers major stock movements as root causes.

AI Key Findings - Processing

Key findings are being generated. Please check back in a few minutes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning DAGs from Data with Few Root Causes

Chris Wendler, Panagiotis Misiakos, Markus Püschel

A Causal Approach to Detecting Multivariate Time-series Anomalies and Root Causes

Kun Zhang, Steven C. H. Hoi, Wenzhuo Yang

No citations found for this paper.

Comments (0)