Summary

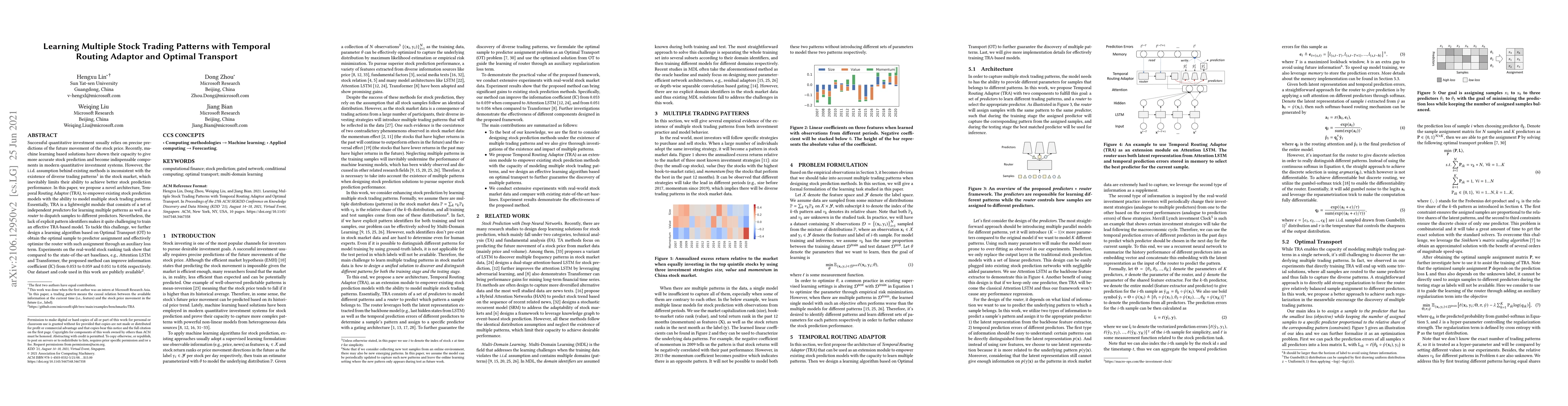

Successful quantitative investment usually relies on precise predictions of the future movement of the stock price. Recently, machine learning based solutions have shown their capacity to give more accurate stock prediction and become indispensable components in modern quantitative investment systems. However, the i.i.d. assumption behind existing methods is inconsistent with the existence of diverse trading patterns in the stock market, which inevitably limits their ability to achieve better stock prediction performance. In this paper, we propose a novel architecture, Temporal Routing Adaptor (TRA), to empower existing stock prediction models with the ability to model multiple stock trading patterns. Essentially, TRA is a lightweight module that consists of a set of independent predictors for learning multiple patterns as well as a router to dispatch samples to different predictors. Nevertheless, the lack of explicit pattern identifiers makes it quite challenging to train an effective TRA-based model. To tackle this challenge, we further design a learning algorithm based on Optimal Transport (OT) to obtain the optimal sample to predictor assignment and effectively optimize the router with such assignment through an auxiliary loss term. Experiments on the real-world stock ranking task show that compared to the state-of-the-art baselines, e.g., Attention LSTM and Transformer, the proposed method can improve information coefficient (IC) from 0.053 to 0.059 and 0.051 to 0.056 respectively. Our dataset and code used in this work are publicly available: https://github.com/microsoft/qlib/tree/main/examples/benchmarks/TRA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPractical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

Deep Q-Network (DQN) multi-agent reinforcement learning (MARL) for Stock Trading

John Christopher Tidwell, John Storm Tidwell

MOT: A Mixture of Actors Reinforcement Learning Method by Optimal Transport for Algorithmic Trading

Jinghao Zhang, Xi Cheng, Yunan Zeng et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)