Summary

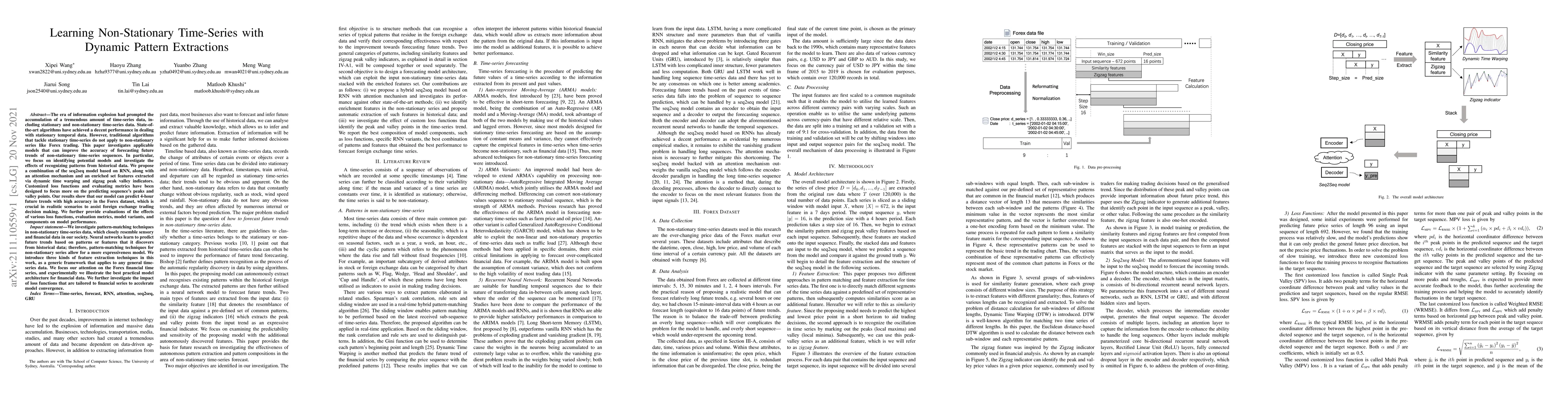

The era of information explosion had prompted the accumulation of a tremendous amount of time-series data, including stationary and non-stationary time-series data. State-of-the-art algorithms have achieved a decent performance in dealing with stationary temporal data. However, traditional algorithms that tackle stationary time-series do not apply to non-stationary series like Forex trading. This paper investigates applicable models that can improve the accuracy of forecasting future trends of non-stationary time-series sequences. In particular, we focus on identifying potential models and investigate the effects of recognizing patterns from historical data. We propose a combination of \rebuttal{the} seq2seq model based on RNN, along with an attention mechanism and an enriched set features extracted via dynamic time warping and zigzag peak valley indicators. Customized loss functions and evaluating metrics have been designed to focus more on the predicting sequence's peaks and valley points. Our results show that our model can predict 4-hour future trends with high accuracy in the Forex dataset, which is crucial in realistic scenarios to assist foreign exchange trading decision making. We further provide evaluations of the effects of various loss functions, evaluation metrics, model variants, and components on model performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynaConF: Dynamic Forecasting of Non-Stationary Time Series

Siqi Liu, Andreas Lehrmann

Koopa: Learning Non-stationary Time Series Dynamics with Koopman Predictors

Yong Liu, Mingsheng Long, Jianmin Wang et al.

Deep Frequency Derivative Learning for Non-stationary Time Series Forecasting

Wei Fan, Qi Zhang, Zhiyuan Ning et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)