Authors

Summary

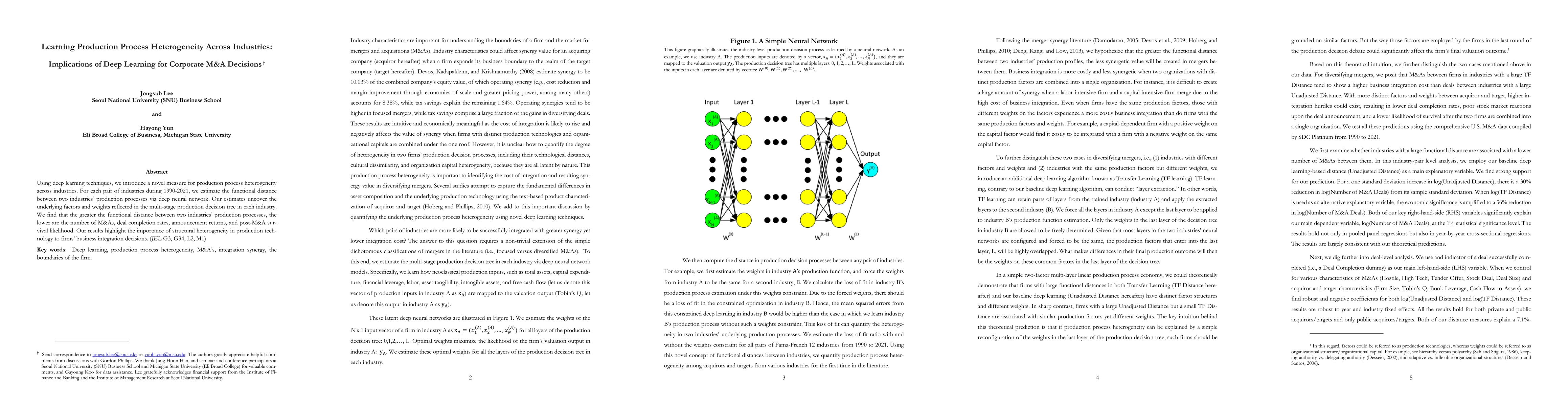

Using deep learning techniques, we introduce a novel measure for production process heterogeneity across industries. For each pair of industries during 1990-2021, we estimate the functional distance between two industries' production processes via deep neural network. Our estimates uncover the underlying factors and weights reflected in the multi-stage production decision tree in each industry. We find that the greater the functional distance between two industries' production processes, the lower are the number of M&As, deal completion rates, announcement returns, and post-M&A survival likelihood. Our results highlight the importance of structural heterogeneity in production technology to firms' business integration decisions.

AI Key Findings

Generated Sep 05, 2025

Methodology

This study uses a combination of econometric analysis and industry classification to investigate the relationship between production process heterogeneity and merger activity.

Key Results

- The study finds that both unadjusted distance and TF distance measures are significant predictors of merger activity.

- The results suggest that production process heterogeneity is related to merger activity, but the two measures capture different dimensions of this relationship.

- The study's findings have implications for our understanding of merger synergy and the role of production process differences in driving merger activity.

Significance

This research is important because it sheds light on the mechanisms underlying merger activity and provides insights into the factors that drive synergy between firms.

Technical Contribution

The study makes a novel contribution to our understanding of merger activity by providing new evidence on the role of production process differences in driving synergy between firms.

Novelty

This research is distinct from existing studies because it uses a unique dataset and combines econometric analysis with industry classification to investigate the relationship between production process heterogeneity and merger activity.

Limitations

- The study's analysis is limited to a specific dataset and may not be generalizable to all industries or mergers.

- The results are based on a simplified measure of production process heterogeneity and do not account for other potential factors that may influence merger activity.

Future Work

- Further research could investigate the role of other factors, such as firm size or market structure, in driving merger activity.

- A more detailed analysis of the mechanisms underlying merger synergy could provide additional insights into the relationship between production process heterogeneity and merger activity.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHandling Device Heterogeneity for Deep Learning-based Localization

Ahmed Shokry, Moustafa Youssef

Addressing Heterogeneity in Federated Learning: Challenges and Solutions for a Shared Production Environment

Martin Ruskowski, Vinit Hegiste, Tatjana Legler et al.

Three-layer deep learning network random trees for fault detection in chemical production process

Ming Lu, Zhen Gao, Pei Li et al.

No citations found for this paper.

Comments (0)