Summary

In financial engineering, prices of financial products are computed approximately many times each trading day with (slightly) different parameters in each calculation. In many financial models such prices can be approximated by means of Monte Carlo (MC) simulations. To obtain a good approximation the MC sample size usually needs to be considerably large resulting in a long computing time to obtain a single approximation. In this paper we introduce a new approximation strategy for parametric approximation problems including the parametric financial pricing problems described above. A central aspect of the approximation strategy proposed in this article is to combine MC algorithms with machine learning techniques to, roughly speaking, learn the random variables (LRV) in MC simulations. In other words, we employ stochastic gradient descent (SGD) optimization methods not to train parameters of standard artificial neural networks (ANNs) but to learn random variables appearing in MC approximations. We numerically test the LRV strategy on various parametric problems with convincing results when compared with standard MC simulations, Quasi-Monte Carlo simulations, SGD-trained shallow ANNs, and SGD-trained deep ANNs. Our numerical simulations strongly indicate that the LRV strategy might be capable to overcome the curse of dimensionality in the $L^\infty$-norm in several cases where the standard deep learning approach has been proven not to be able to do so. This is not a contradiction to lower bounds established in the scientific literature because this new LRV strategy is outside of the class of algorithms for which lower bounds have been established in the scientific literature. The proposed LRV strategy is of general nature and not only restricted to the parametric financial pricing problems described above, but applicable to a large class of approximation problems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

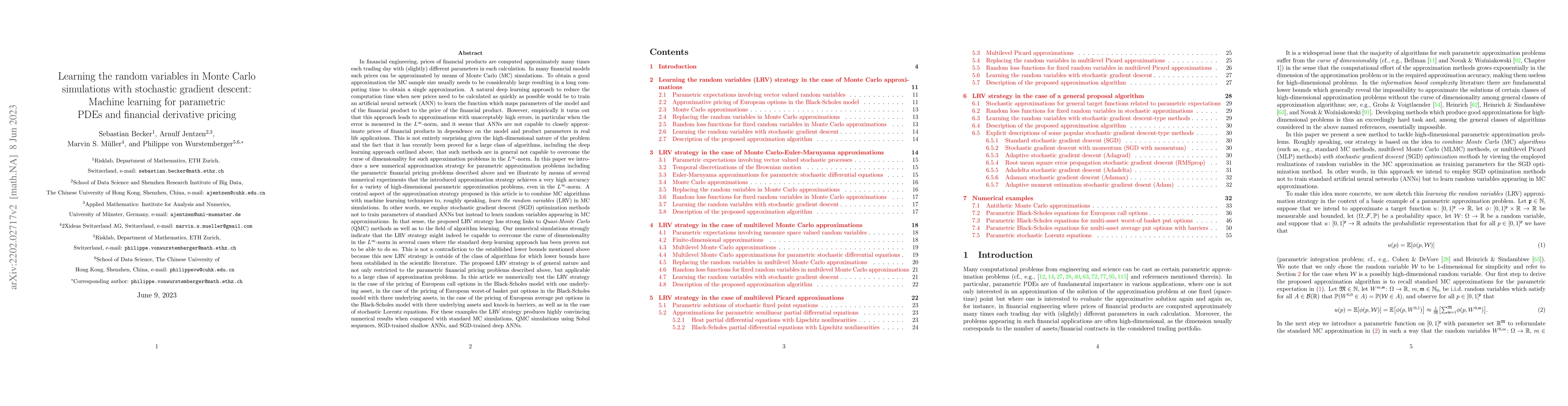

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Methods for Pricing Financial Derivatives

Lei Fan, Justin Sirignano

| Title | Authors | Year | Actions |

|---|

Comments (0)