Authors

Summary

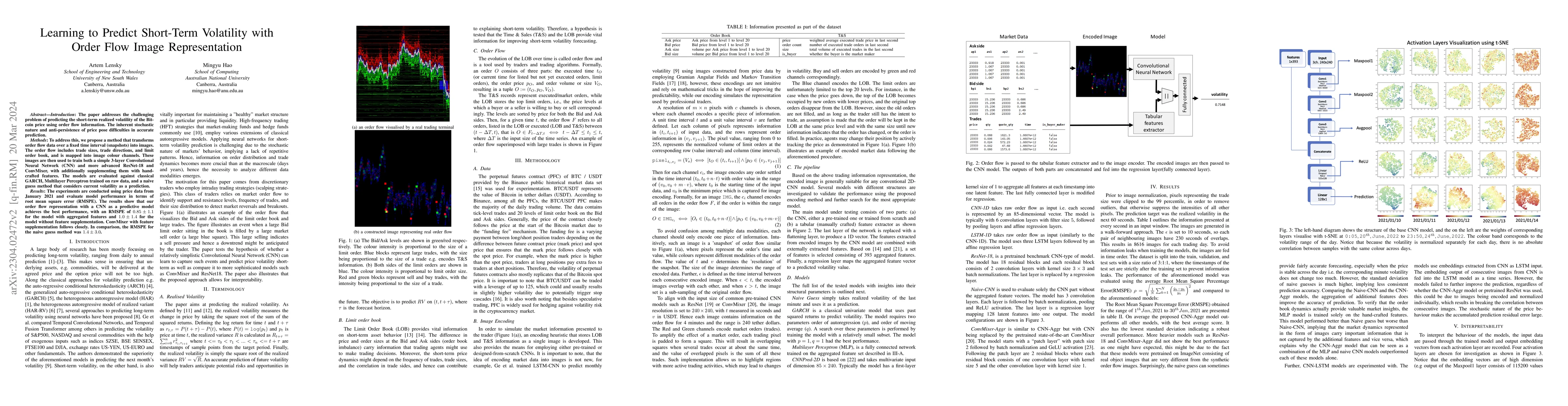

Introduction: The paper addresses the challenging problem of predicting the short-term realized volatility of the Bitcoin price using order flow information. The inherent stochastic nature and anti-persistence of price pose difficulties in accurate prediction. Methods: To address this, we propose a method that transforms order flow data over a fixed time interval (snapshots) into images. The order flow includes trade sizes, trade directions, and limit order book, and is mapped into image colour channels. These images are then used to train both a simple 3-layer Convolutional Neural Network (CNN) and more advanced ResNet-18 and ConvMixer, with additionally supplementing them with hand-crafted features. The models are evaluated against classical GARCH, Multilayer Perceptron trained on raw data, and a naive guess method that considers current volatility as a prediction. Results: The experiments are conducted using price data from January 2021 and evaluate model performance in terms of root mean square error (RMSPE). The results show that our order flow representation with a CNN as a predictive model achieves the best performance, with an RMSPE of 0.85+/-1.1 for the model with aggregated features and 1.0+/-1.4 for the model without feature supplementation. ConvMixer with feature supplementation follows closely. In comparison, the RMSPE for the naive guess method was 1.4+/-3.0.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVideo-based Person Re-identification with Long Short-Term Representation Learning

Pingping Zhang, Huchuan Lu, Xuehu Liu

Short-term Volatility Estimation for High Frequency Trades using Gaussian processes (GPs)

Leonard Mushunje, Maxwell Mashasha, Edina Chandiwana

No citations found for this paper.

Comments (0)