Authors

Summary

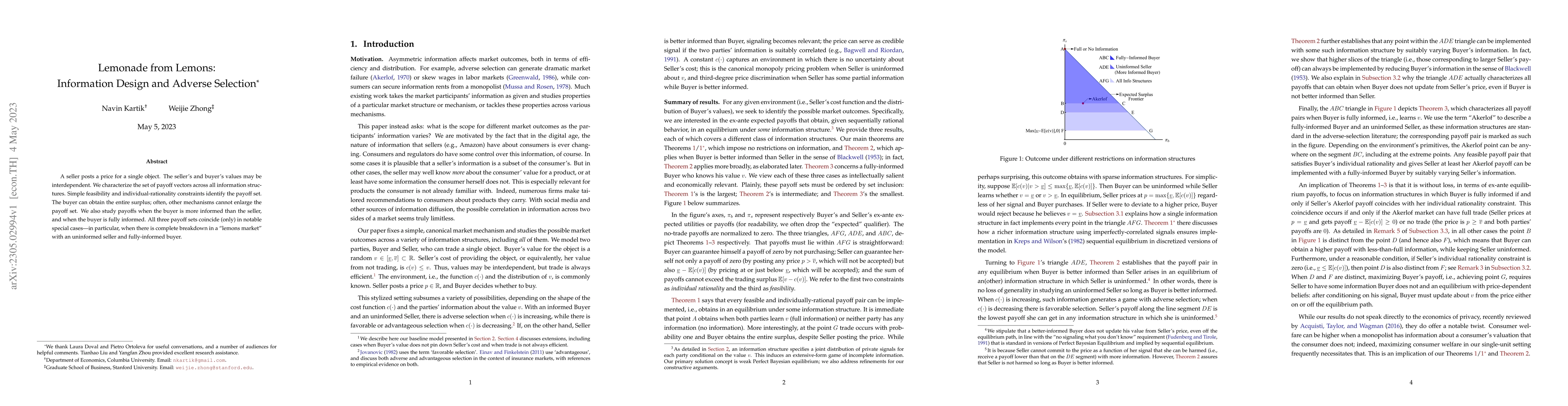

A seller posts a price for a single object. The seller's and buyer's values may be interdependent. We characterize the set of payoff vectors across all information structures. Simple feasibility and individual-rationality constraints identify the payoff set. The buyer can obtain the entire surplus; often, other mechanisms cannot enlarge the payoff set. We also study payoffs when the buyer is more informed than the seller, and when the buyer is fully informed. All three payoff sets coincide (only) in notable special cases -- in particular, when there is complete breakdown in a ``lemons market'' with an uninformed seller and fully-informed buyer.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGenerative AI and Information Asymmetry: Impacts on Adverse Selection and Moral Hazard

Yukun Zhang, Tianyang Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)