Authors

Summary

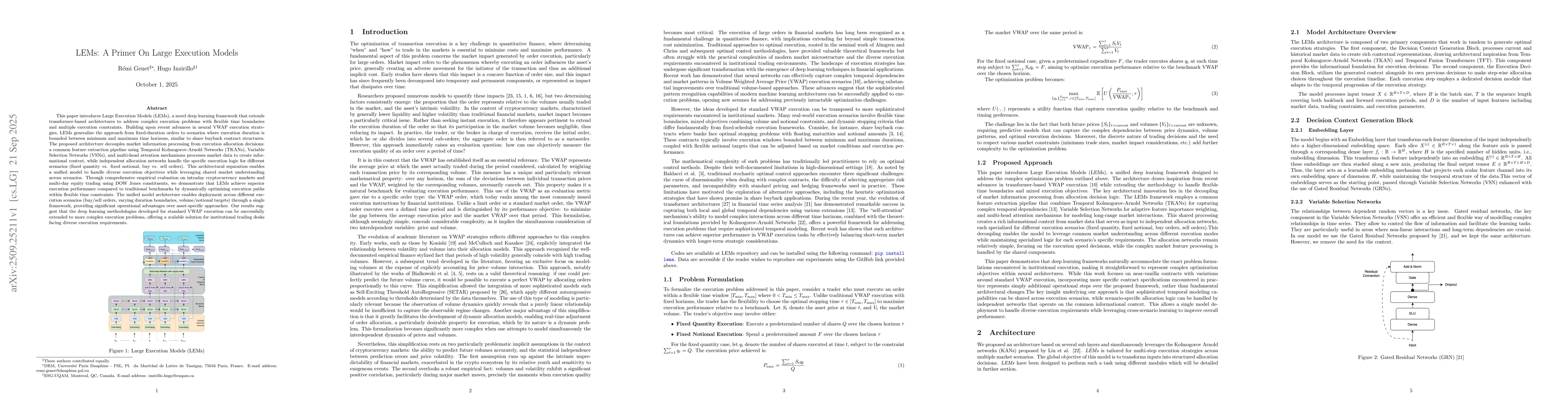

This paper introduces Large Execution Models (LEMs), a novel deep learning framework that extends transformer-based architectures to address complex execution problems with flexible time boundaries and multiple execution constraints. Building upon recent advances in neural VWAP execution strategies, LEMs generalize the approach from fixed-duration orders to scenarios where execution duration is bounded between minimum and maximum time horizons, similar to share buyback contract structures. The proposed architecture decouples market information processing from execution allocation decisions: a common feature extraction pipeline using Temporal Kolmogorov-Arnold Networks (TKANs), Variable Selection Networks (VSNs), and multi-head attention mechanisms processes market data to create informational context, while independent allocation networks handle the specific execution logic for different scenarios (fixed quantity vs. fixed notional, buy vs. sell orders). This architectural separation enables a unified model to handle diverse execution objectives while leveraging shared market understanding across scenarios. Through comprehensive empirical evaluation on intraday cryptocurrency markets and multi-day equity trading using DOW Jones constituents, we demonstrate that LEMs achieve superior execution performance compared to traditional benchmarks by dynamically optimizing execution paths within flexible time constraints. The unified model architecture enables deployment across different execution scenarios (buy/sell orders, varying duration boundaries, volume/notional targets) through a single framework, providing significant operational advantages over asset-specific approaches.

AI Key Findings

Generated Oct 02, 2025

Methodology

The research employs deep learning frameworks, specifically Temporal Kolmogorov-Arnold Networks (TKAN) and Transformer models, to optimize VWAP execution strategies in both traditional and cryptocurrency markets. It integrates market microstructure data and uses layered normalization and exponential linear units (ELUs) for enhanced performance.

Key Results

- The proposed models significantly reduce execution risk and improve trade efficiency compared to traditional VWAP strategies.

- TKAN and Transformer-based approaches demonstrate superior adaptability to dynamic market conditions and volume fluctuations.

- The study confirms the effectiveness of deep learning in modeling complex execution mandates and structured trading contracts.

Significance

This research advances algorithmic trading by providing scalable, data-driven solutions for institutional investors, enabling more precise control over trading costs and market impact in diverse financial markets.

Technical Contribution

The paper introduces TKAN architecture combined with Transformer models, creating a novel framework for time-series forecasting and execution strategy optimization that addresses limitations in traditional VWAP approaches.

Novelty

This work introduces Temporal Kolmogorov-Arnold Networks (TKAN) for VWAP execution, combining temporal modeling with functional analysis, and extends deep learning applications to structured trading contracts in both traditional and crypto markets.

Limitations

- The models require extensive historical market data for training, which may not be readily available for all asset classes.

- Performance may degrade in ultra-low liquidity environments where traditional VWAP strategies are typically used.

Future Work

- Integration of real-time market microstructure features for enhanced predictive capabilities.

- Development of multi-asset strategies that leverage cross-asset correlations.

- Exploration of alternative data sources such as alternative trading system (ATS) data.

Paper Details

PDF Preview

Similar Papers

Found 5 papersA Primer on Large Language Models and their Limitations

Sandra Johnson, David Hyland-Wood

Demystifying Large Language Models for Medicine: A Primer

Guangzhi Xiong, Qiao Jin, Zhiyong Lu et al.

Primer on large language models: an educational overview for intensivists.

Idan, Daphna, Einav, Sharon

A Primer on the Inner Workings of Transformer-based Language Models

Gabriele Sarti, Arianna Bisazza, Marta R. Costa-jussà et al.

Comments (0)