Summary

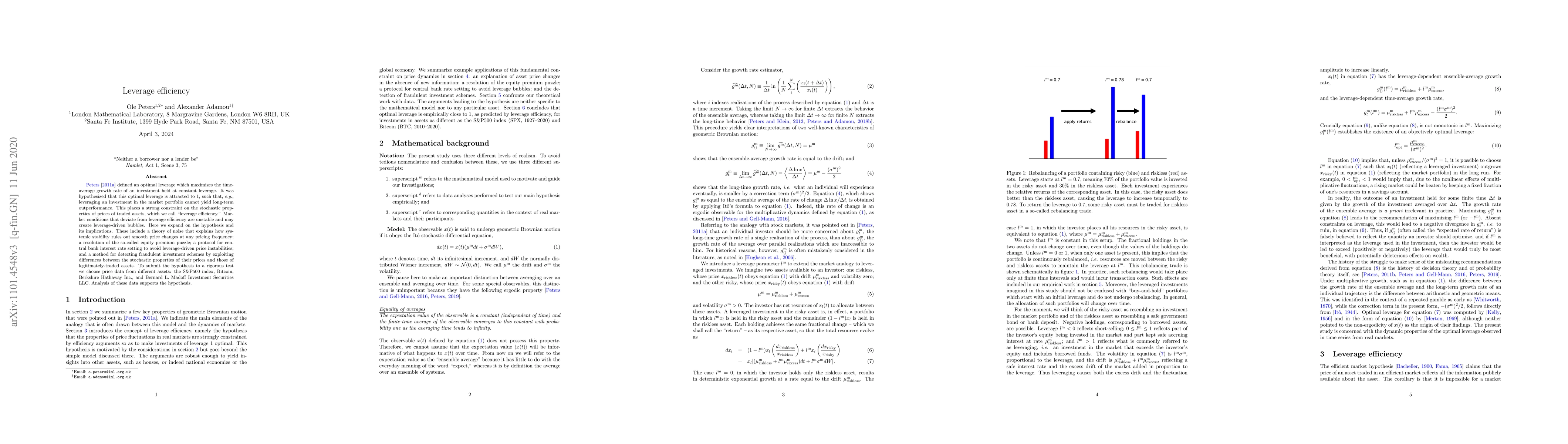

Peters (2011a) defined an optimal leverage which maximizes the time-average growth rate of an investment held at constant leverage. It was hypothesized that this optimal leverage is attracted to 1, such that, e.g., leveraging an investment in the market portfolio cannot yield long-term outperformance. This places a strong constraint on the stochastic properties of prices of traded assets, which we call "leverage efficiency." Market conditions that deviate from leverage efficiency are unstable and may create leverage-driven bubbles. Here we expand on the hypothesis and its implications. These include a theory of noise that explains how systemic stability rules out smooth price changes at any pricing frequency; a resolution of the so-called equity premium puzzle; a protocol for central bank interest rate setting to avoid leverage-driven price instabilities; and a method for detecting fraudulent investment schemes by exploiting differences between the stochastic properties of their prices and those of legitimately-traded assets. To submit the hypothesis to a rigorous test we choose price data from different assets: the S&P500 index, Bitcoin, Berkshire Hathaway Inc., and Bernard L. Madoff Investment Securities LLC. Analysis of these data supports the hypothesis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVcLLM: Video Codecs are Secretly Tensor Codecs

Xinyu Yang, Beidi Chen, Yongji Wu et al.

Efficient Reinforcement Learning On Passive RRAM Crossbar Array

Arjun Tyagi, Shubham Sahay

| Title | Authors | Year | Actions |

|---|

Comments (0)