Authors

Summary

This paper explores the application of Sample Entropy (SampEn) as a sophisticated tool for quantifying and predicting volatility in international oil price returns. SampEn, known for its ability to capture underlying patterns and predict periods of heightened volatility, is compared with traditional measures like standard deviation. The study utilizes a comprehensive dataset spanning 27 years (1986-2023) and employs both time series regression and machine learning methods. Results indicate SampEn's efficacy in predicting traditional volatility measures, with machine learning algorithms outperforming standard regression techniques during financial crises. The findings underscore SampEn's potential as a valuable tool for risk assessment and decision-making in the realm of oil price investments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

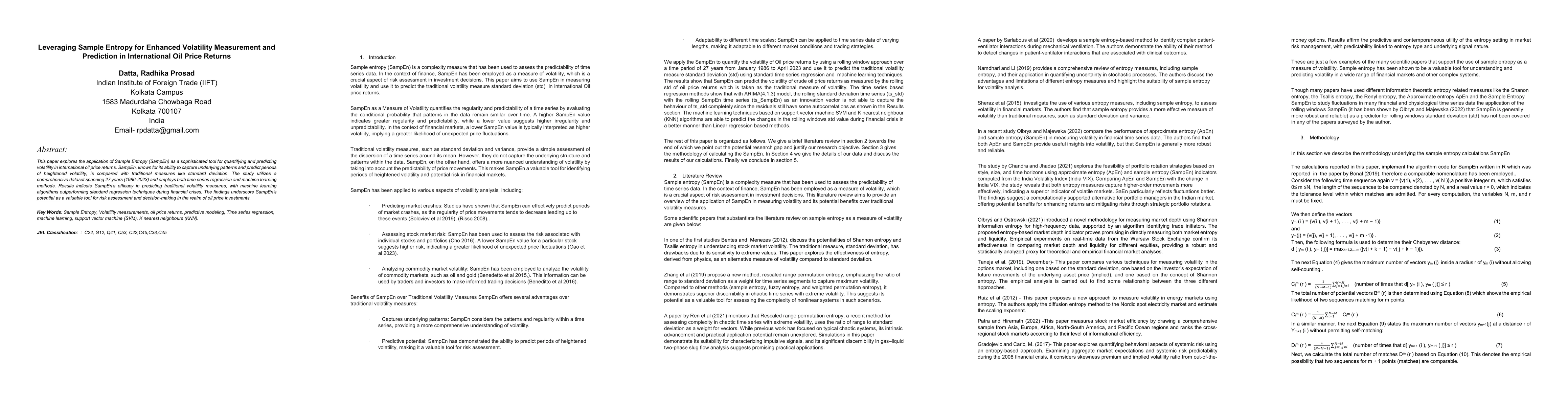

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Trading under Instantaneous and Persistent Price Impact, Predictable Returns and Multiscale Stochastic Volatility

Ronnie Sircar, Patrick Chan, Iosif Zimbidis

No citations found for this paper.

Comments (0)