Authors

Summary

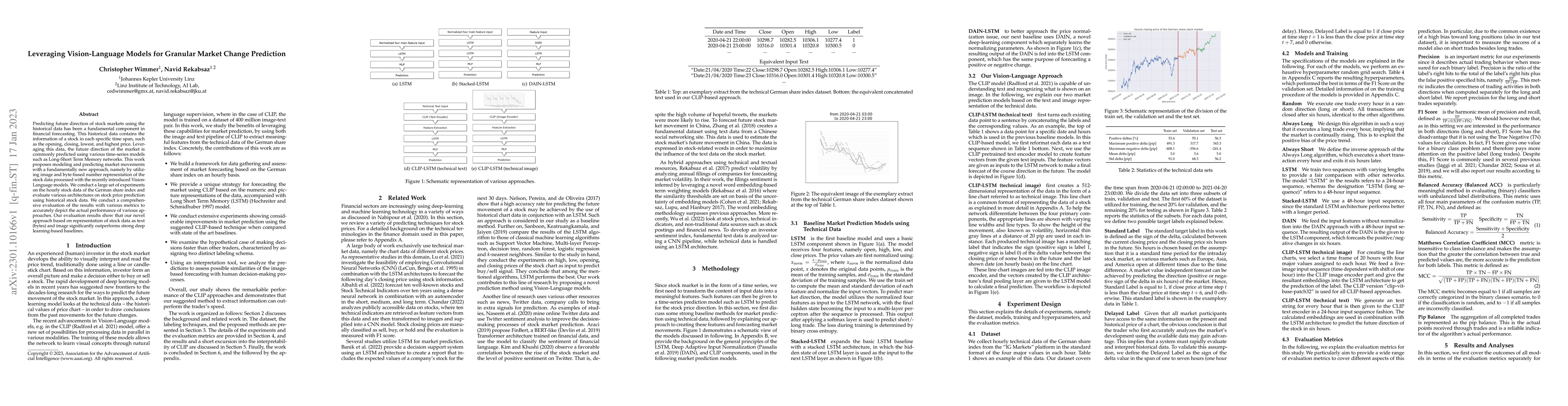

Predicting future direction of stock markets using the historical data has been a fundamental component in financial forecasting. This historical data contains the information of a stock in each specific time span, such as the opening, closing, lowest, and highest price. Leveraging this data, the future direction of the market is commonly predicted using various time-series models such as Long-Short Term Memory networks. This work proposes modeling and predicting market movements with a fundamentally new approach, namely by utilizing image and byte-based number representation of the stock data processed with the recently introduced Vision-Language models. We conduct a large set of experiments on the hourly stock data of the German share index and evaluate various architectures on stock price prediction using historical stock data. We conduct a comprehensive evaluation of the results with various metrics to accurately depict the actual performance of various approaches. Our evaluation results show that our novel approach based on representation of stock data as text (bytes) and image significantly outperforms strong deep learning-based baselines.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProgressive Multi-granular Alignments for Grounded Reasoning in Large Vision-Language Models

Truyen Tran, Ngan Le, Long Hoang Dang et al.

Advanced Feature Manipulation for Enhanced Change Detection Leveraging Natural Language Models

Zhenglin Li, Jingyu Zhang, Mengran Zhu et al.

BeamLLM: Vision-Empowered mmWave Beam Prediction with Large Language Models

Zitong Yu, Can Zheng, Jiguang He et al.

Pedestrian Intention Prediction via Vision-Language Foundation Models

He Wang, Mohsen Azarmi, Mahdi Rezaei

| Title | Authors | Year | Actions |

|---|

Comments (0)