Authors

Summary

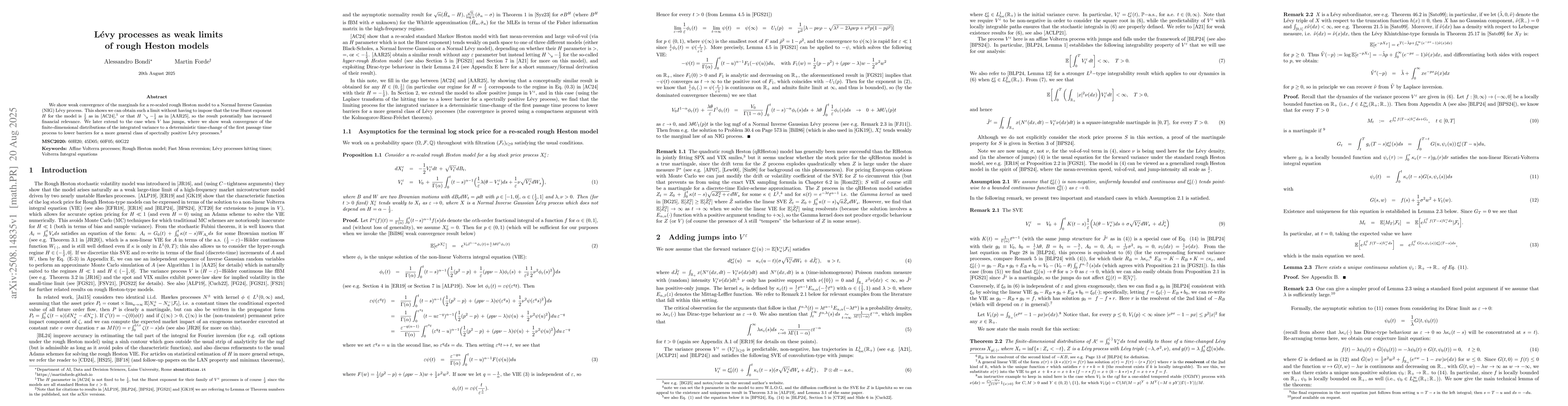

We show weak convergence of the marginals for a re-scaled rough Heston model to a Normal Inverse Gaussian (NIG) L\'{e}vy process. This shows we can obtain such a limit without having to impose that the true Hurst exponent $H$ for the model is $\frac{1}{2}$ as in [Abi Jaber, & De Carvalho, 2024], or that $H\searrow -\frac{1}{2}$ as in [Abi Jaber, Attal, & Rosenbaum, 2025], so the result potentially has increased financial relevance. We later extend to the case when $V$ has jumps, where we show weak convergence of the finite-dimensional distributions of the integrated variance to a deterministic time-change of the first passage time process to lower barriers for a more general class of spectrally positive L\'{e}vy processes.

AI Key Findings

Generated Aug 21, 2025

Methodology

The research establishes weak convergence of a re-scaled rough Heston model to a Normal Inverse Gaussian (NIG) Lévy process, extending to the case when V has jumps, showing weak convergence of the integrated variance to a deterministic time-change of the first passage time process to lower barriers for a more general class of spectrally positive Lévy processes.

Key Results

- Weak convergence of re-scaled rough Heston model to NIG Lévy process.

- No requirement for true Hurst exponent H to be 1/2 or H → -1/2.

- Extension to models with integrated variance jumps.

- Weak convergence of finite-dimensional distributions to a time-changed Lévy process.

Significance

This research has increased financial relevance as it removes restrictions on the Hurst exponent, potentially broadening applicability in financial modeling.

Technical Contribution

Development of a framework for analyzing rough volatility models through weak convergence to Lévy processes, relaxing previous constraints on the Hurst parameter.

Novelty

The study introduces a novel approach by demonstrating weak convergence without strict conditions on the Hurst parameter, thus expanding the applicability of rough Heston models in finance.

Limitations

- Theoretical findings may require further empirical validation in financial contexts.

- Assumptions and simplifications inherent in the mathematical model may not fully capture real-world market complexities.

Future Work

- Investigate practical implications in financial derivatives pricing and risk management.

- Explore extensions to more complex asset pricing models incorporating stochastic volatility and jumps.

Comments (0)